Whats the "Father of the 401k" concerned about 40 yrs later?

Alright, so you remember Ted Benna, right? They call him the “Father of the 401(k)” because he helped create that retirement savings plan way back in 1978. But guess what? He’s not all sunshine and rainbows about it after analyzing it 40 year history. He’s got some serious concerns, my friend.

First off, he’s worried that the 401(k) puts a lot of pressure on us regular folks when it comes to being ready for retirement. It’s like we’re on our own, and not everyone knows how to manage their savings like a pro. So, we might end up making bad investment choices and not saving enough for those golden years. Not cool, right?

And that’s not all. Some people just aren’t putting in enough money into their 401(k)s. Yeah, it lets you stash away some cash before taxes, but not everyone is taking advantage of it. Could be because of money troubles or just not having a clue about finances and stuff. Short-term needs vs. long-term goals, you know how it is.

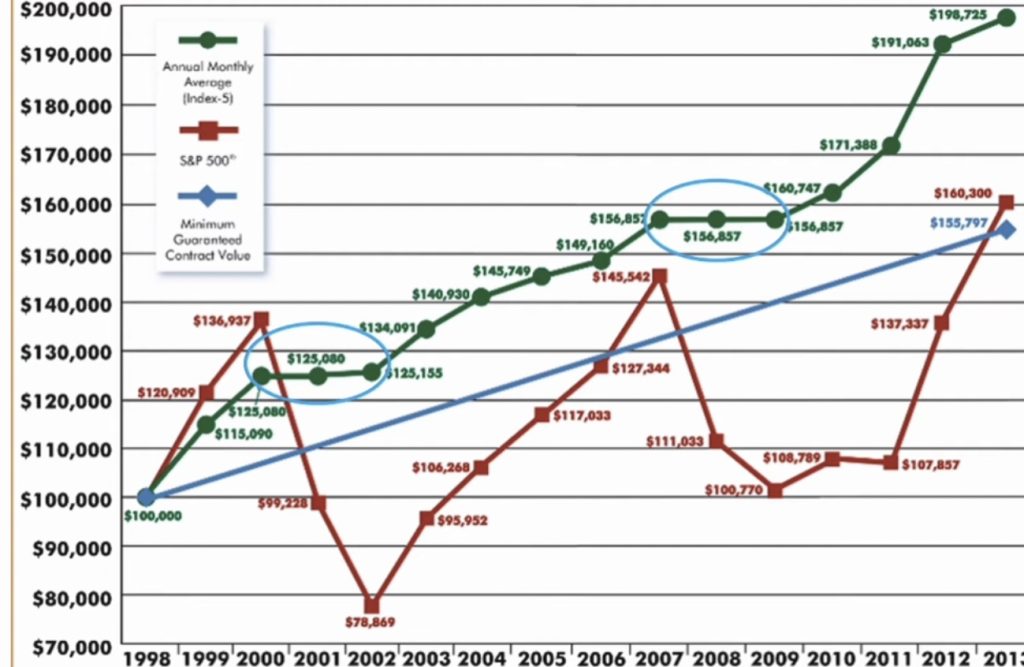

Oh, and brace yourself for the roller coaster ride of the financial markets! 401(k) plans usually involve investing in them, so we’re in for all the ups and downs. Ted Benna is really worried that those wild market swings could mess with our retirement savings, especially when the economy takes a nosedive.

Then there are these pesky fees and expenses eating away at our hard-earned savings. Some 401(k) plans have high administrative fees and investment costs, which means we might end up with less money to play within our retirement.

And here’s the real kicker – the whole 401(k) thing could actually make income inequality worse. Crazy, right? Critics say it mostly benefits those who are already raking in the big bucks, while folks with lower incomes might struggle to save enough. It’s like the rich get richer, and the rest of us are left behind.

But hold on, there’s more. Traditional 401(k) plans are tied to our employers. So, if your company doesn’t offer one or limits our investment options, we’re stuck. It’s like our retirement fate is in our employer’s hands, and that’s not always a good thing.

Now, before you start panicking, Ted Benna isn’t all doom and gloom. He still believes in saving for retirement, and he thinks the 401(k) can be useful if we use it wisely. He just wants us to be aware of its flaws and make smart decisions about our future. In his book “The Father of the 401k” he recommends some other better options since the average American is facing a retirement income problem.

Check out the solutions we offer for a tax-free retirement plan that won’t have you bracing yourself for the roller coaster ride of the financial markets!

And guess what? There’s hope, my friend!

ReplyForward |