Why are We Seeing Many More People Working in Their 70s?

You won’t believe this, but retirement planning is becoming more critical than ever before! People are working well beyond the typical retirement age, and there are a couple of reasons behind this trend that you’ve got to know.

First off, here’s the good news – people are aging better these days, thanks to improvements in healthcare and healthier lifestyles. So, they’re able to work longer and stay healthier for a more extended period. It’s like getting more mileage out of life, and that’s pretty cool, right?

But wait, there’s a flip side to this. Many seniors are facing a not-so-cool reality: they don’t have as much retirement savings as they expected. Especially those who didn’t have those fancy jobs with pensions or those who maxed out their 401k plans . Can you believe that only around 35% of Americans between 55 and 64 have retirement savings like a 401(k) or IRA? Yikes! And get this – experts recommend having about six times your current income saved up by the time you’re 50 for a comfortable retirement. But guess what? Even those who do have retirement savings only have a median account balance of $88,000 and will see 30% or more gobbled up by taxes. Not quite enough to live that dream retirement life we all imagine.

So, what’s the solution? Well, many seniors are choosing to delay retirement to save up more money for their golden years. The longer they work, the more they can collect from Social Security when they finally retire. It’s like giving themselves a raise for life! Now, that’s a smart move, don’t you think?

But not everyone can keep working past 65 and not everyone wants to. Some seniors have jobs that are physically demanding or require them to take on caregiving responsibilities, so working longer isn’t always an option for them. And for those facing a retirement savings crunch, it’s not a solution that works for everyone.

Here’s another twist to the story – women and people of color face extra challenges when it comes to retirement. They often have lower incomes compared to white men, which makes it harder for them to save enough for their golden years. And certain industries can be tough on them physically, making it even more challenging to keep working longer.

So, with all this in mind, it’s essential to explore retirement solutions that can work for everyone, no matter their job or background. And guess what? An IUL (Indexed Universal Life) insurance policy from National Life Group could be a fantastic option to consider!

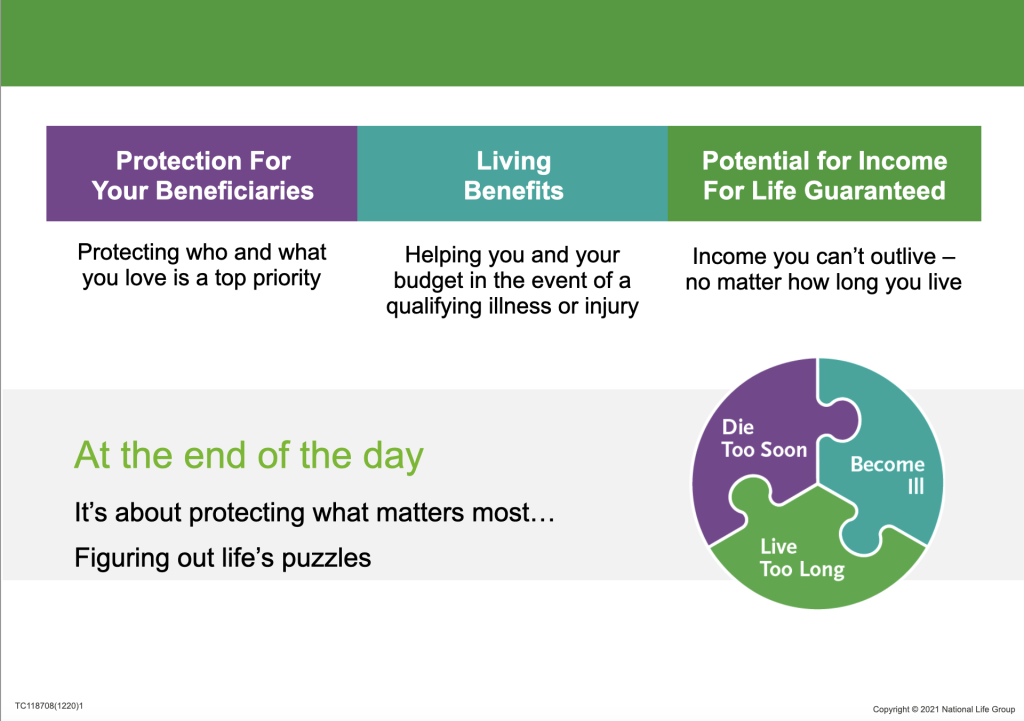

An IUL policy offers flexible tax free income distributions up to age 120 – yes, you read that right! You’ll have more control over your money during retirement. Plus, the cash value grows tax-free, and there are no contribution limits. It’s like having the best of both worlds – protection for your loved ones and a source of income that lasts well into your golden years. Another factor is as we age the chances of chronic, critical, or terminal illness increases greatly and that’s where “Living Benefits” can be triggered allowing access to up to $1.5 million in benefits paid directly to the policy holder tax free, and it’s not a loan that has to be repaid either.

So, the next time you think about retirement planning, keep an IUL policy from National Life Group in mind. It could be the perfect puzzle piece to secure your financial future and enjoy a well-deserved retirement instead of working in your 70s or running out of money in retirement?