The Need for Long-Term Care is growing ... how an IUL Helps

One of life’s greatest challenges is dealing with Long-Term Care.

The following statistics show how the need for Long-Term Care is increasing:

Care is becoming more complex: 49% of care recipients require help in “all aspects of daily living,” and only 8% need “very minor assistance.” The biggest increase was in cognitive impairments (32% up from 26% in 2018).

Care duration is increasing: The average duration of a care event has gone from 3 years in 2018 to 3.5 years in 2021.

Preference for care at home: 79% of care recipients prefer at-home care to facility care.

Family caregivers’ impact on employment: Providing care negatively affected the ability to work for 56% of women and 45% of men caregivers. 40% of men and 27% of women believed they lost a majority of their annual income due to caregiving.

Financial burden of providing care: Caregivers in 2021 were more likely to use savings/retirement funds, reduce contributions to savings, and borrow money from friends or family.

Impact on caregivers’ health: 59% of women reported that providing care negatively affected their health, compared to 43% of men. Many caregivers experienced stress, sleep deprivation, isolation, guilt, and weight gain.

Caregiving experiences across demographics: The physical, financial, emotional, and psychological strain of caregiving is similar across different ethnicities.

Long Term Care Insurance (LTCI) usage: Only 14% of cases utilized LTC insurance, which helped reduce financial hardship and provided flexibility in receiving care.

Attitudes toward LTCI: 4 out of 5 adults have taken action to increase their level of financial preparedness for long-term care due to lessons learned from COVID-19.

These statistics highlight the increasing complexity of caregiving, the growing need for long-term care, the financial burden on caregivers, and the potential benefits of Long Term Care Insurance in addressing these challenges

National Life Group’s IUL (Indexed Universal Life) insurance, with its Living Benefits, offers a unique solution to address the challenges of long-term care. The Living Benefits feature provides policyholders with access to funds in the event of chronic or critical care needs, covering both physical and cognitive illnesses. This helps policyholders and their families cope with the financial strain and emotional burden associated with providing long-term care.

Here’s how Living Benefits from National Life Group’s IUL can address the problem:

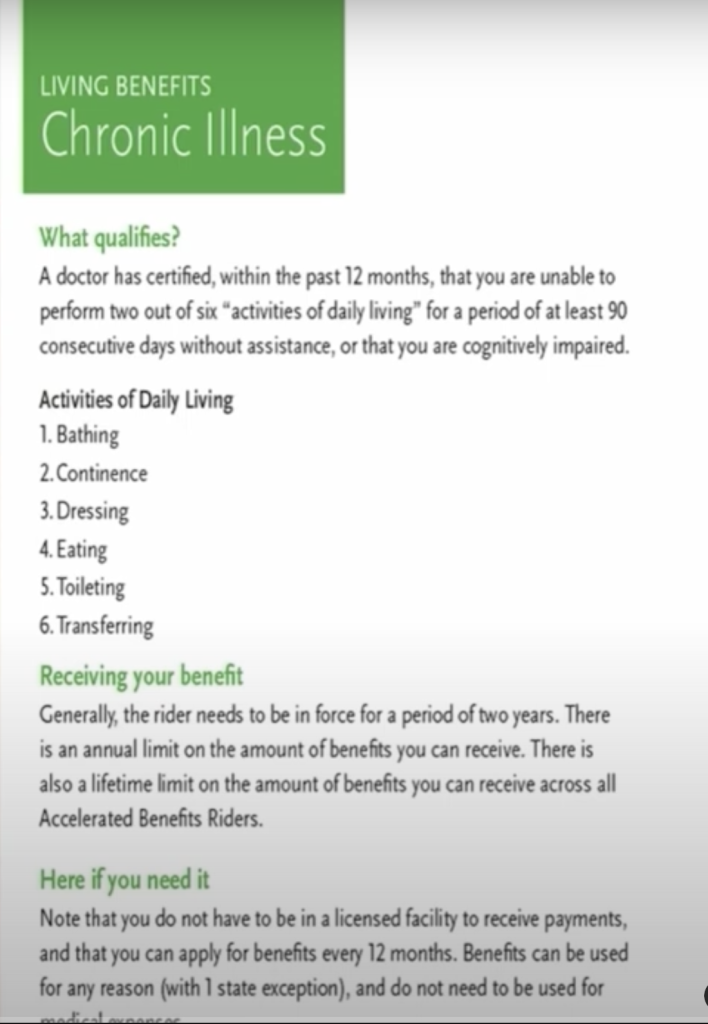

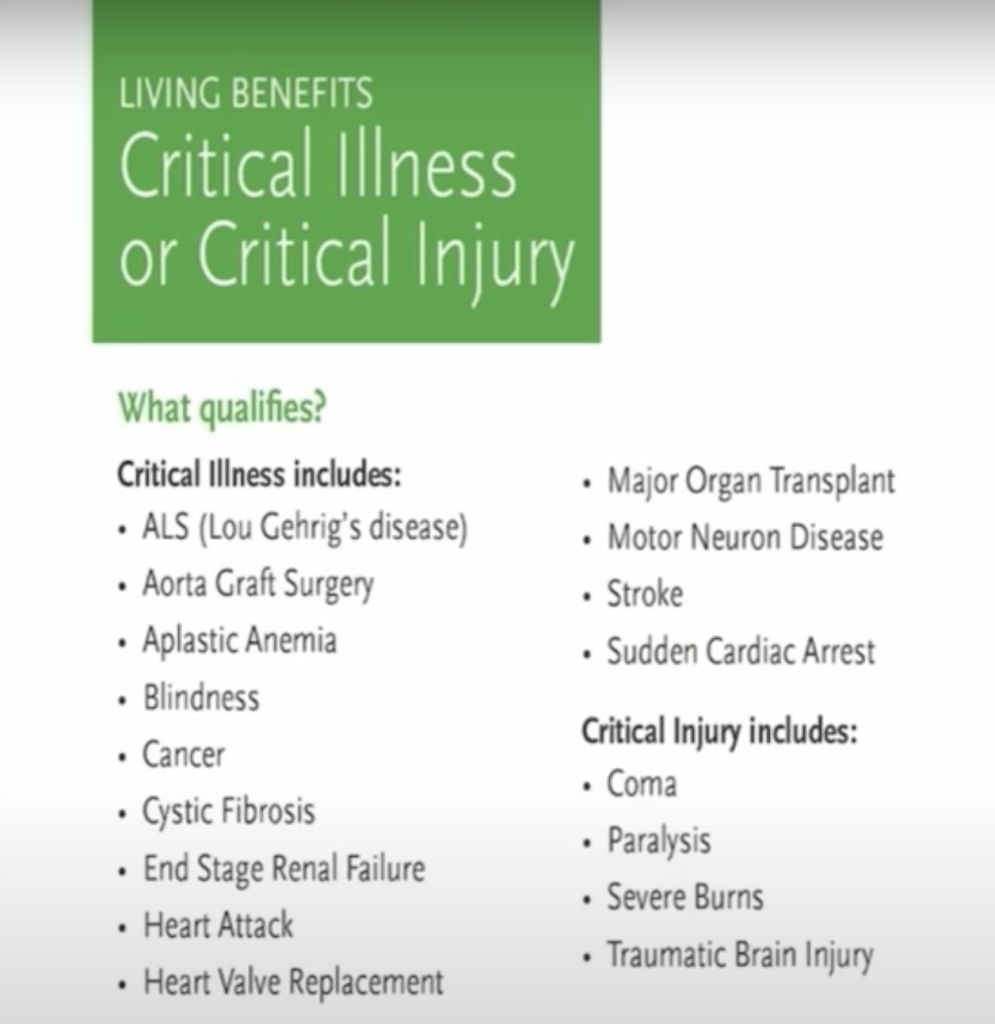

Comprehensive coverage: The Living Benefits cover a wide range of care needs, including chronic and critical illnesses. This means that policyholders can receive financial assistance for various medical conditions that require long-term care, whether it’s for physical limitations, cognitive impairments, or other health issues.

Access to funds: Policyholders can access a portion of the death benefit while they are still alive if they meet the criteria for chronic or critical care. This allows them to use the funds to pay for medical expenses, home care services, assisted living, or any other care-related costs, helping them maintain their quality of life.

Flexibility in care options: With Living Benefits, policyholders have the flexibility to choose the type of care they need, whether it’s receiving care at home or in a facility. This provides peace of mind knowing that they can make decisions about their care without solely relying on family members or being restricted to a specific care setting.

Alleviating financial burden: Long-term care expenses can quickly deplete savings and retirement funds. Living Benefits provide a safety net, ensuring that policyholders have access to funds when they need them most, without having to resort to draining personal savings or selling assets.

Planning for the future: The Living Benefits feature encourages individuals to plan ahead for potential long-term care needs. With the knowledge that their policy can provide support during difficult times, individuals can better prepare for the financial aspects of aging and illness. These benefits are included in every IUL at no additional cost to the policyholder.

In summary, National Life Group’s IUL with Living Benefits addresses the long-term care problem by offering a comprehensive and flexible solution to policyholders. By providing access to funds for chronic and critical care, this insurance option helps individuals and their families navigate the challenges of caregiving and ensures a level of financial security during times of need.