How Can a Max-Funded IUL be the Key to a Successful Retirement

Hey there, folks under 50! Let’s talk about securing your retirement in a way that’s not only convincing but super positive. We all want that peace of mind for our golden years, right? Well, that’s where we come in as tax-free retirement specialists. Our mission is to ensure you have a rock-solid retirement plan, and we’ve got some fantastic strategies to make it happen.

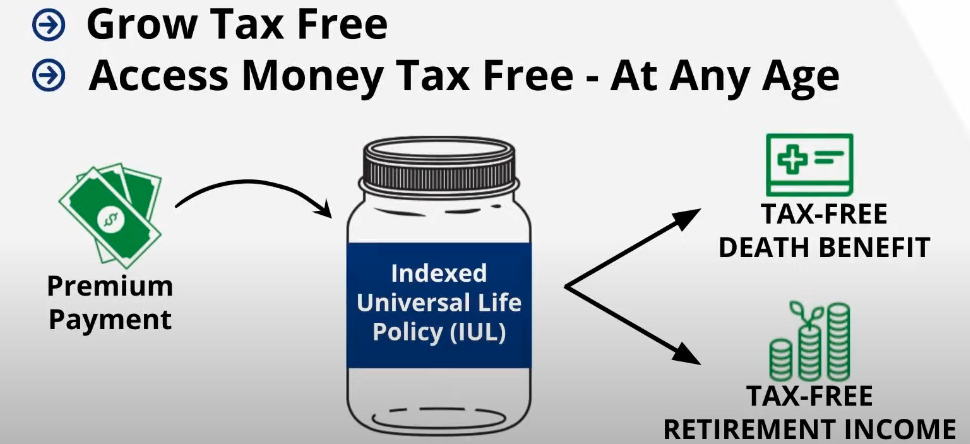

First on the list is a Max-Funded IUL(Indexed Universal Life) contract.

So, what’s the secret sauce to safeguarding your retirement? It boils down to four key aspects which the Max-Funded IUL covers nicely:

Income Protection: We make sure your retirement income is as steady as a rock. No more worrying about market ups and downs.

Market Risk Mitigation: We shield you from market volatility. You won’t lose sleep over market crashes.

Tax Efficiency: We’re all about minimizing your tax burden. You won’t be handing over your hard-earned money to the taxman.

Lifetime Income: We ensure you never run out of money during retirement. That’s the top concern for most of us these days, right?

Think of the IUL as a financial superhero, the lovechild of a Roth IRA and a life insurance policy.

You’ve heard about the perks of a Roth IRA, right? Tax-free withdrawals down the road. Well, an IUL brings its A-game to the table too. Here’s the kicker: your money grows, guaranteed, every single year.

But wait, how is this magic allowed, you ask? The IRS has three secret codes: TEFRA, DEFRA, and TEMRA. These codes are like your financial invisibility cloak. They let your money grow tax-deferred, and your beneficiaries receive it as a tax-free windfall. It’s a win-win!

Now, let’s talk strategy. Our max-funded IUL is designed to be super-efficient. We channel the least amount of your premium into insurance and maximize the funds for future retirement growth. That’s why it’s called “max-funded.”

Here’s the golden ticket: IRS code section 7702 makes all this possible. It allows your money to grow tax-free. Plus, you can access your funds tax-free whenever you need them. And when retirement rolls around, your income will be tax-free too. It’s like a financial fairytale come true!

Ever heard of the 401(k) trap? You can’t touch that money until you’re 59 1/2 without penalties. But with an IUL, no penalties for early withdrawals. That’s freedom and flexibility.

And guess what? Your IUL cash is virtually untouchable, even in sticky situations like legal troubles. It’s a fortress of financial security.

So, if you’re under 50 and dreaming of a retirement that’s secure, tax-free, and worry-free, an indexed universal life policy could be your ticket to financial freedom. Say goodbye to retirement worries and hello to your stress-free future!