Buy Term & Invest the Rest- Is there a Better Way?

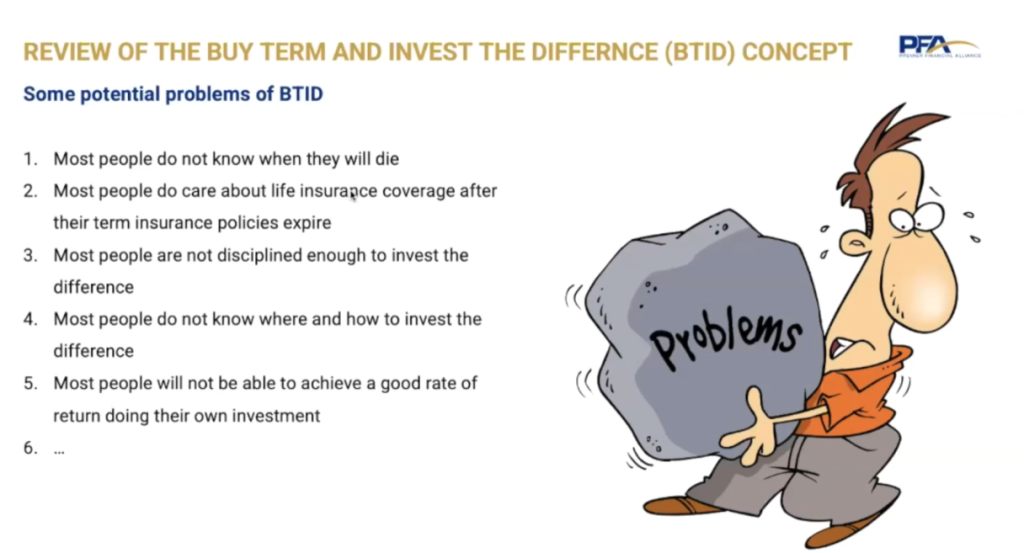

You may have heard the advice to “Buy Term & Invest the Rest.” It sounds great in theory: get a term life insurance policy and invest the extra money you save. But here’s the reality – many people don’t actually invest that difference. They might show you charts and graphs proving that if you invest wisely, you’ll have enough money after 30 years to ditch your life insurance policy. So, why do so many folks in their 60s and 70s still buy more life insurance? It’s a puzzling question.

Let’s rewind to 1980 when EF Hutton, a brokerage firm, was pushing mutual fund investments with a goal of a 12% average return. But the market, as we know, can be unpredictable – up one moment, down the next. This volatility often leaves people frustrated, especially when you take a few steps backward after making progress. For instance, between 2001 and 2003, many Americans lost 40% of their hard-earned money in IRAs and 401(k)s. It took four long years to recover those losses. Then, in 2008, it happened again.

Here’s a fact worth remembering: a study by DALBAR found that the average American investor in the market only earns about 3.5%. That’s why the financial industry came up with the 4% rule, which suggests you should only withdraw 4% a year from your retirement savings. So, if you had a million dollars, that’s just $40,000 per year. And after taxes, you’d be left with even less. Add in fees charged by money managers, and your net income might shrink further.

Now, consider this: with a traditional investment approach, you might end up with just $30,000 a year from your million-dollar nest egg. That’s not much to live on, is it? This is precisely why “Buy Term & Invest the Rest” can leave retirees in a tight spot.

But here’s a different path, one EF Hutton considered back in the 1980s. Instead of relying solely on the market, why not put your money into the multi-trillion-dollar insurance industry? Insurance companies have a history of stability. During the Great Depression, when banks were collapsing, not a single legal reserve insurance company went under. Fast forward to 2008, a near financial collapse, and guess what? Insurance companies stood strong. None of them failed.

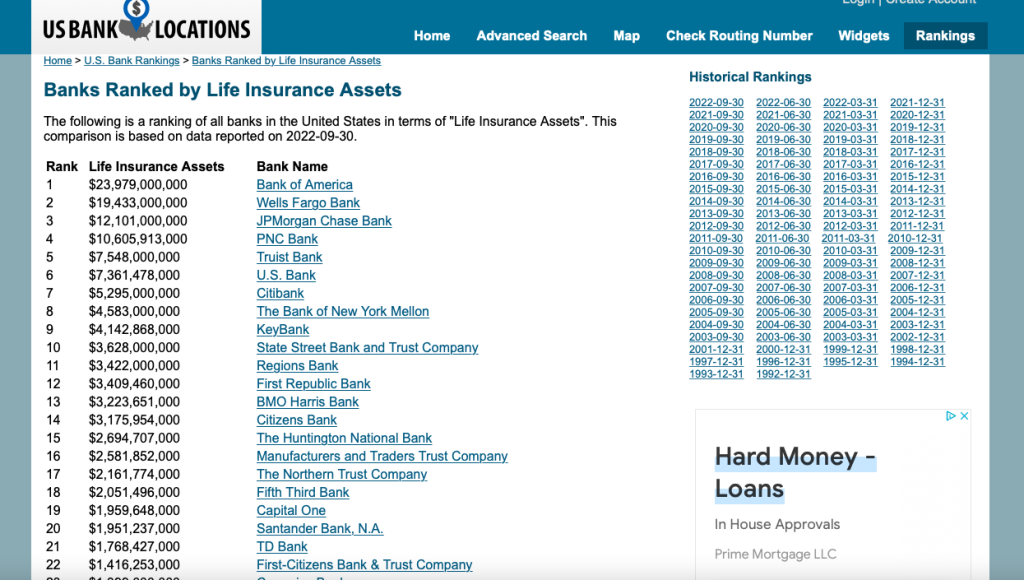

Why is this important? Insurance companies are typically rated AAA, six notches higher in safety than most banks. Banks offer minimal interest rates while insurance companies often provide a safer haven with better returns. In fact, the five major banks in America allocate a substantial chunk of their assets to insurance companies, boosting their safety.

Insurance companies, on average, offered a 5% return from 2000 to 2012, much more than what banks offer. That’s a 500% increase in returns! If someone could make you an extra $50,000 while costing you only $10,000, wouldn’t you hire them?

The money inside an insurance contract has been a secret tax-free asset for over a century. Why? Because the government benefits when you accumulate, access, and transfer your money tax-free. It takes the pressure off the government to provide welfare benefits for retirees, widows, and orphans.

So, when someone advises you to “Buy Term & Invest the Rest,” consider this alternative: invest under a tax-free umbrella and retain your life insurance for life. It’s a simple, safe, and convincing way to secure your financial future.