The Missing Safety Net in Retirement: The Case for Indexed Universal Life Insurance

Retirement planning is a crucial aspect of financial well-being. People spend decades saving and investing to ensure a comfortable retirement, but one significant gap in most retirement strategies is the absence of a safety net in case of chronic, critical, or terminal illness. Traditional retirement accounts and investment strategies typically focus on wealth accumulation and may not adequately address the pressing need for protection in these dire circumstances. In this article, we will explore how Indexed Universal Life (IUL) insurance can provide a unique solution by offering living benefits, including disability coverage and senior care, all in one package.

The Problem with Traditional Retirement Plans

Traditional retirement planning often revolves around 401(k)s, IRAs, and other investment vehicles designed primarily for wealth accumulation. While these accounts are crucial for building a nest egg for retirement, they may fall short when it comes to safeguarding against unexpected health challenges. Here are some key shortcomings of relying solely on these plans:

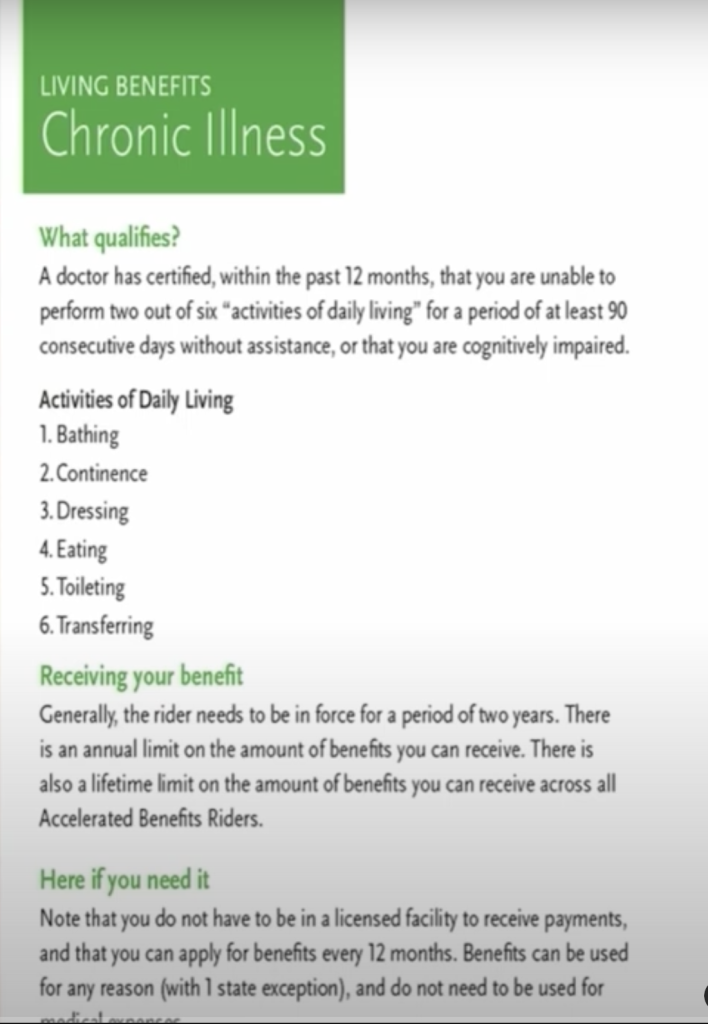

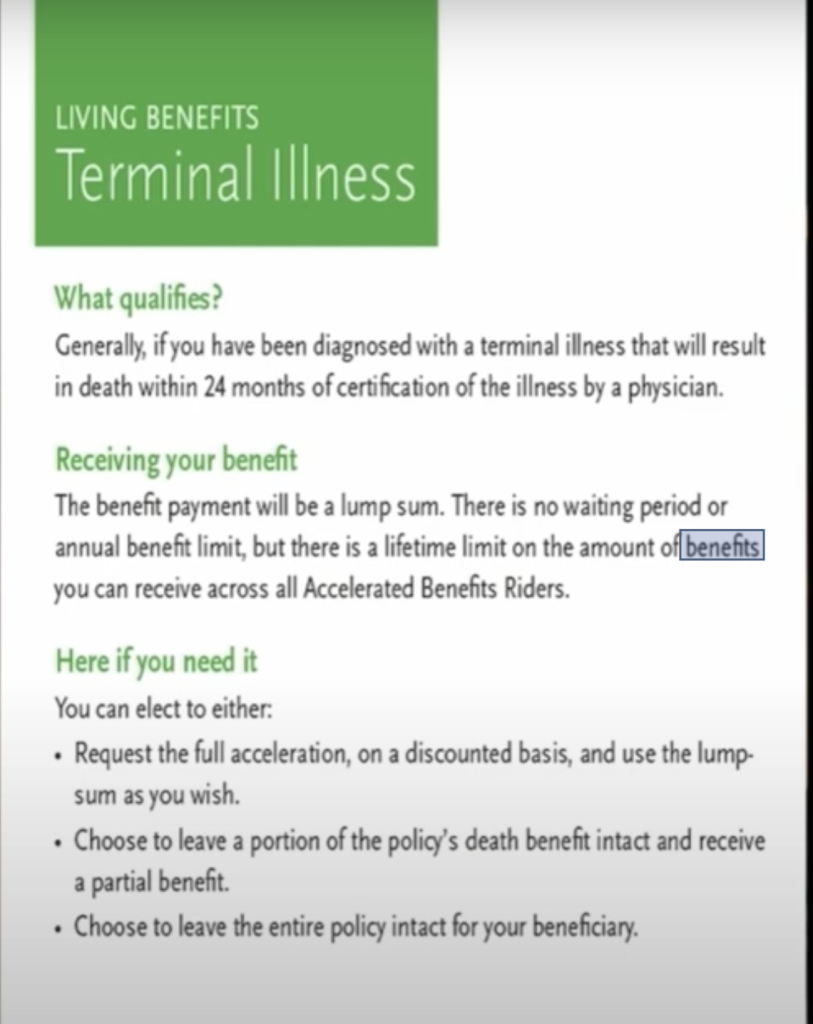

- Lack of Living Benefits: Traditional retirement accounts do not offer living benefits, meaning they do not provide financial assistance if you experience a chronic, critical, or terminal illness during your retirement years. This leaves retirees vulnerable to the high costs associated with healthcare and long-term care services.

- No Disability Coverage: Traditional retirement plans do not include disability coverage, leaving individuals without a source of income if they become disabled and unable to work. Disability insurance is often overlooked but is critical for financial security.

- Senior Care Expenses: As individuals age, the likelihood of needing long-term care services, such as nursing homes or home healthcare, increases. Traditional retirement plans do not account for these expenses, which can be exorbitant and quickly deplete retirement savings.

The Indexed Universal Life (IUL) Solution

Indexed Universal Life (IUL) insurance is a versatile financial product that bridges the gap in retirement planning by offering a comprehensive solution for living benefits, disability coverage, and senior care. Here’s how IUL addresses these issues:

- Living Benefits: IUL policies often come with living benefits that allow policyholders to access a portion of their death benefit while they are still alive if they are diagnosed with a chronic, critical, or terminal illness. This can provide much-needed financial support during challenging times without depleting retirement savings.

- Disability Coverage: Many IUL policies can be customized to include disability income riders. These riders provide a monthly income if the policyholder becomes disabled and is unable to work. This ensures a continued stream of income to cover living expenses, even in the event of a disability.

- Senior Care Coverage: IUL policies can also be tailored to include coverage for long-term care expenses. This means that if you require senior care services, such as assisted living or nursing home care, your IUL policy can help offset the substantial costs associated with these services.

The Cost-Efficiency of IUL

One might argue that purchasing separate insurance policies for living benefits, disability coverage, and senior care can be expensive. However, IUL offers a cost-effective solution by combining these coverages into one policy. This not only streamlines your insurance portfolio but can also be more affordable than purchasing multiple standalone policies.

Furthermore, the cash value component of an IUL policy can provide additional financial flexibility during retirement. Policyholders can access the cash value to supplement their retirement income, cover unexpected expenses, or even use it to pay for premiums if needed. This added flexibility can be invaluable in ensuring financial stability during retirement.

Conclusion

Retirement planning should encompass more than just accumulating wealth; it should also include a safety net to protect against the financial challenges that can arise due to chronic, critical, or terminal illnesses, as well as disability and senior care needs. While traditional retirement strategies often fall short in this regard, Indexed Universal Life (IUL) insurance offers a comprehensive solution that includes living benefits, disability coverage, and senior care, all in one package. Moreover, the cost-efficiency of IUL makes it a compelling choice for those seeking a well-rounded and financially secure retirement plan. By considering IUL as part of your retirement strategy, you can help ensure a more robust and resilient financial future.