The Unwavering Financial Strength of Life Insurance Companies vs. Banks: A 150-Year Analysis

For over a century and a half, life insurance companies and banks have played pivotal roles in the financial stability of individuals and institutions. Both have been entrusted with safeguarding and managing vast sums of money, but the resilience and financial strength of life insurance companies have consistently outshone banks. In this comprehensive analysis, we will contrast the track records of life insurance companies and banks in terms of financial stability and resilience, with a focus on historical data and recent statistics up to 2023.

Historical Overview

Life Insurance Companies:

1. **Consistency through Time**: Life insurance companies have maintained a remarkable track record of financial strength over the past 150 years. Their ability to meet long-term financial obligations has been a cornerstone of their existence. Statistics from the late 1800s to the early 2000s consistently reflect their enduring strength.

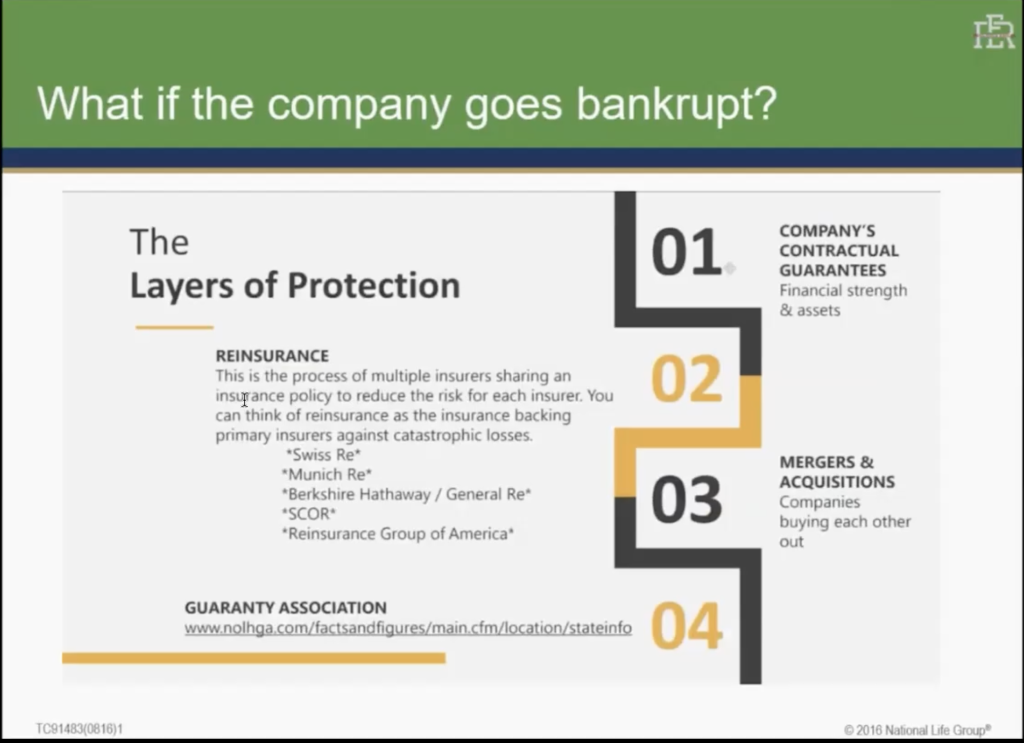

2. **Low Failure Rate**: Data reveals that life insurance companies have experienced far fewer failures compared to banks during this time span. This stability is due to their prudent investment strategies, actuarial expertise, and focus on long-term policyholder commitments.

Banks:

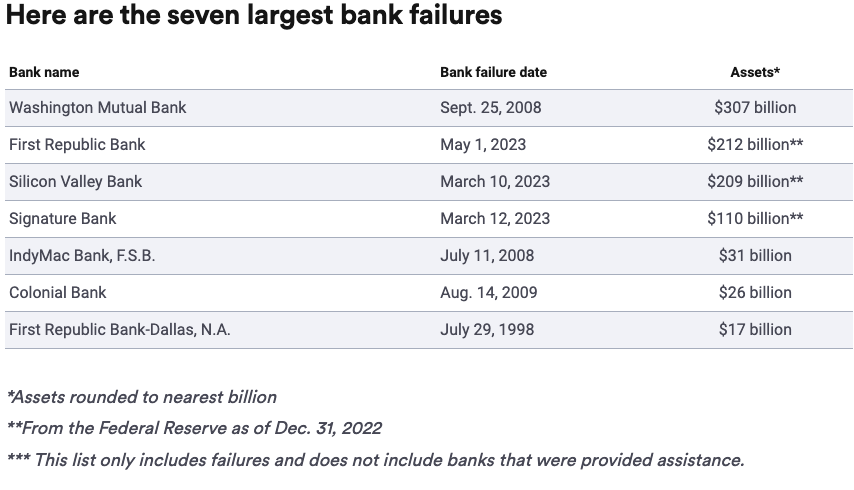

1. **Historical Bank Failures**: Banks have, on the other hand, been susceptible to numerous crises and failures. Historical financial crises, including the Great Depression and the 2008 financial crisis, have exposed the vulnerability of banks to economic shocks.

2. **Cycles of Boom and Bust**: Banks are intrinsically tied to the economic cycle and speculative lending practices, leading to a pattern of boom and bust. The financial instability of banks during these cycles can have severe consequences for depositors and the broader economy.

Recent Data and Trends

Life Insurance Companies:

1. **Steady Growth**: Recent statistics up to 2023 show that life insurance companies have continued to grow steadily. The life insurance industry has seen an increase in policyholder funds, premiums, and investment returns, indicating strong financial health.

2. **High Solvency Ratios**: Solvency ratios, a key indicator of financial strength, have consistently remained high for life insurers. These ratios reflect their ability to cover policyholder claims and maintain stability in adverse economic conditions.

Banks:

1. **Recent Bank Failures**: In contrast, banks have faced challenges in the form of smaller regional bank failures and crises. These events highlight the ongoing fragility of the banking industry.

2. **Regulatory Reforms**: Regulatory reforms have been implemented in response to the 2008 financial crisis to mitigate the risks associated with the banking sector. However, these reforms have not eliminated the potential for bank failures entirely.

Conclusion

In the context of a 150-year analysis, life insurance companies have demonstrated an unwavering commitment to financial stability. Their focus on long-term obligations, prudent investment strategies, and high solvency ratios have allowed them to maintain their strength through various economic cycles. Banks, on the other hand, have been marked by a history of financial crises and a susceptibility to economic shocks.

While banks have implemented reforms to enhance their stability, the contrast in the historical record remains clear. Life insurance companies have consistently provided policyholders with security and financial strength, making them a reliable choice for long-term financial planning. The statistics up to 2023 reaffirm this trend, showing that the financial strength of life insurance companies remains robust.

In conclusion, the financial strength of life insurance companies, as contrasted with the instability of banks, underscores the enduring value of life insurance as a secure and dependable financial instrument over the last 150 years and into the future.