Why “Young Boomers” Way Behind “Late Boomers” in Retirement Income: How Market Volatility & Lack of Pension Contributed

Younger baby boomers, referred to as “late boomers” (born 1960-1965), face a substantial shortfall in retirement savings compared to their older counterparts, the “early boomers” (born 1948-1953). A study conducted by the Center for Retirement Research at Boston College sheds light on this significant wealth gap, revealing that, by the time late boomers reached their 50s, they had 19% less retirement wealth than early boomers did at the same age.

According to a study by the Center for Retirement Research at Boston College, the primary driver behind this disparity is attributed to the 2007-2009 financial crisis, commonly known as the Great Recession. The study points out that late boomers were particularly affected by the recession, experiencing substantial earnings losses during that period. This setback had a lasting impact on their ability to accumulate wealth for retirement.

Moreover, late boomers faced a distinctive challenge compared to their predecessors. Unlike early boomers, late boomers navigated their careers and savings in an era where pensions were no longer the prevailing retirement plan. Instead, they relied on defined-contribution plans such as 401(k)s and IRAs. The crucial distinction lies in the nature of these plans—unlike pensions, they do not guarantee a fixed income during retirement.

The absence of pension benefits, coupled with the volatility induced by the 2008-2009 recession, created a double-edged challenge for late boomers. The financial crisis not only led to immediate financial setbacks but also exposed them to the inherent risks associated with market fluctuations. As a result, late boomers faced the dual burden of recovering from the recession’s aftermath while grappling with the uncertainties of relying on market-dependent retirement plans.

The impact of market volatility on late boomers’ retirement savings is evident in their diminished wealth accumulation compared to their early boomer counterparts. The earnings lost during the recession proved to be a significant obstacle, highlighting the vulnerability of relying solely on market-driven investment vehicles.

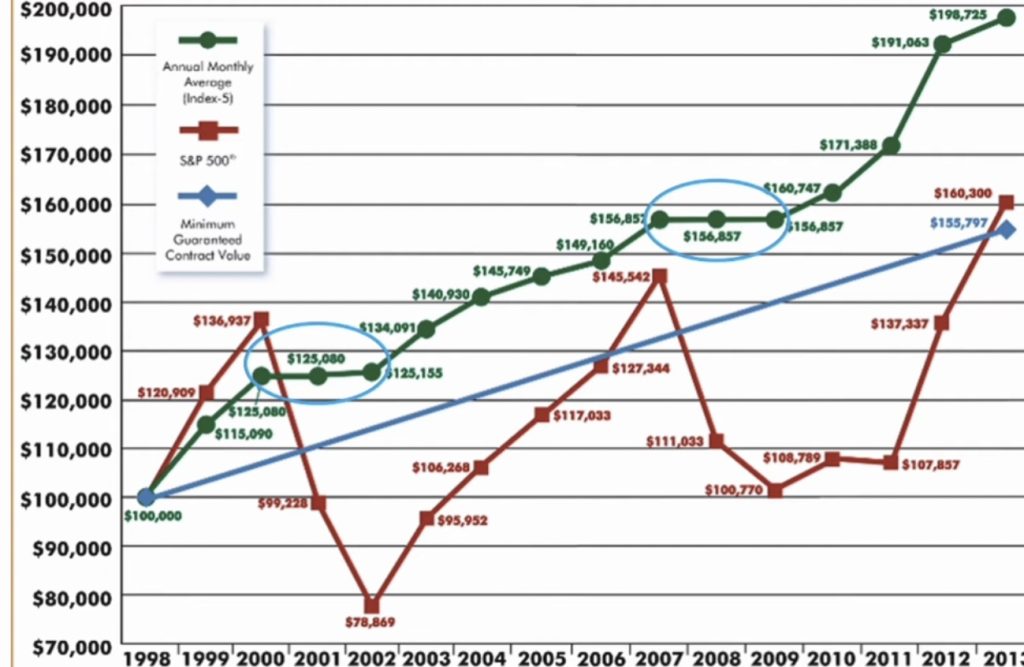

To address this challenge and mitigate the impact of market volatility, financial planners recommend exploring alternative retirement strategies. One such approach involves considering Indexed Universal Life (IUL) insurance policies. Unlike traditional investment vehicles, IULs offer a unique feature that shields policyholders from market downturns. This is achieved through a guaranteed zero-loss provision, ensuring that the policyholder’s money is not at risk in the market.

In contrast to 401(k)s and IRAs, where the performance is directly tied to market conditions, IULs provide a level of financial security by preventing any negative impact on the accumulated cash value during market downturns. This safeguard becomes particularly crucial for late boomers seeking stability in their retirement plans, given their susceptibility to the repercussions of past market volatility.

By incorporating IULs into their retirement strategy, late boomers can potentially safeguard their wealth from future market uncertainties. This approach not only addresses the issue of market volatility but also provides a degree of financial predictability, allowing late boomers to plan for their retirement with more confidence.

In conclusion, the wealth gap in retirement savings between late boomers and early boomers can be attributed to a combination of factors, with the 2007-2009 financial crisis playing a pivotal role. The absence of pensions and the reliance on market-driven retirement plans exposed late boomers to heightened risks, impacting their long-term financial well-being. Exploring alternative strategies, such as incorporating IULs, can offer a more secure path for Millennials, Gen X & Gen Z to navigate the challenges of retirement planning in the face of market volatility and evolving economic landscapes.