Choosing the Right Tax-Free Investment: Roth IRA, Municipal Bonds, or IUL

When it comes to tax-free investments, three popular choices stand out: Roth IRA, Municipal Bonds, and Indexed Universal Life (IUL). Let’s break down the pros and cons of each in simple terms.

1. Roth IRA:

Pros:

- Tax-Free Growth: Your money grows without being taxed, and you won’t pay taxes on qualified withdrawals.

- Flexibility: You can take out your contributions without penalties, providing easy access to your funds.

- Diverse Investments: Invest in stocks, bonds, and mutual funds based on your risk preference.

Cons:

- Contribution Limits: There’s a cap on how much you can invest each year.

- Income Restrictions: High earners may not qualify to contribute directly.

- No Upfront Tax Deduction: Unlike traditional IRAs, contributions are not tax-deductible.

2. Municipal Bonds:

Pros:

- Tax-Free Interest: The interest you earn is often exempt from federal and sometimes state and local taxes.

- Stability: Considered a stable investment for those seeking lower risk.

- Regular Income: Receive periodic interest payments for a steady income.

Cons:

- Lower Returns: Historically, municipal bonds offer lower returns.

- Market Sensitivity: Bond prices can be influenced by interest rate changes.

- Credit Risk: There’s a low risk of default for investment-grade bonds.

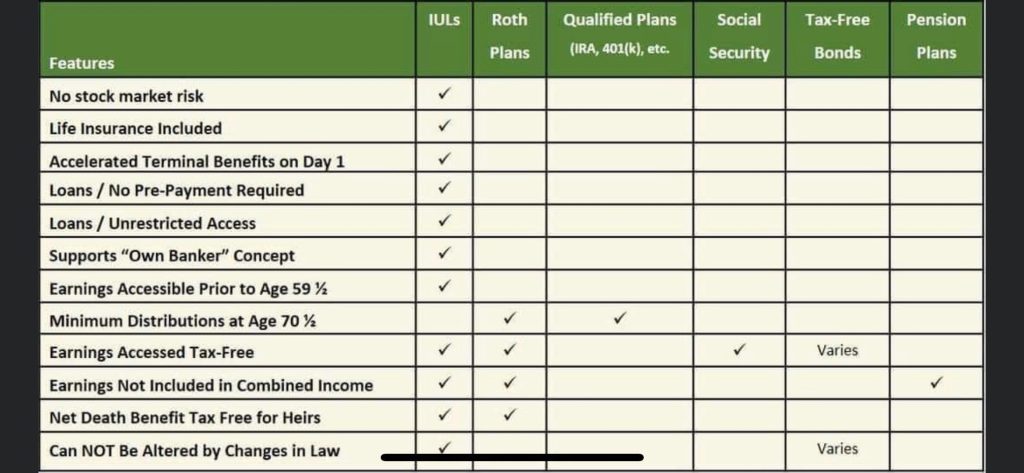

3. Indexed Universal Life (IUL):

Pros:

- Tax-Advantaged Growth: Your cash value grows tax-deferred, and withdrawals can be income-tax-free if structured correctly.

- Flexibility: Adjust premium payments and death benefits over time to match changing financial needs.

- Market Participation: Gain potential linked to market indexes without the usual downside risks.

Cons:

- Complexity: IUL policies can be intricate, requiring a good understanding for maximum benefits.

- Costs: Insurance costs can be slightly higher, but they come with tax-free death benefits and some include Living Benefits at no extra cost.

- Cap on Returns: Some IULs have a cap on maximum gains, unless there’s a high participation rate for greater growth.

In conclusion, the choice depends on your financial goals. Indexed Universal Life (IUL) stands out for those seeking tax-free growth, enhanced returns, and flexibility. Unlike Roth IRAs and municipal bonds with limitations, IULs offer much greater growth potential. Structuring IULs without a cap on returns and with high participation rates can lead to interest rates that surpass other tax-free options.

IULs not only secure your financial future with tax advantages but also provide market participation without major risks. The flexibility to adjust payments and benefits resonates with the dynamic goals of individuals aged 22-50.

Consider the power of IULs as you explore tax-free growth, aligning with the ambitions of forward-thinking investors. Always consult with a financial professional to tailor your strategy to your unique financial journey.slightl