Understanding “Age Savings Run Out”: A Critical Concern for Retirees

Retirement marks a significant life transition where individuals move from the workforce to a stage of financial reliance on accumulated savings and pensions. One of the greatest fears among retirees is the prospect of outliving their savings, commonly referred to as “Age Savings Run Out.” In this article, we will delve into the calculation of this critical metric and explore why the fear of running out of money before death looms large in the minds of retirees.

Calculation of “Age Savings Run Out”:

The calculation of “Age Savings Run Out” involves a complex interplay of various factors, including life expectancy, retirement savings, inflation, investment returns, and spending habits. One commonly used method is the Monte Carlo simulation, which runs multiple scenarios to model potential outcomes based on different market conditions.

1.Life Expectancy:

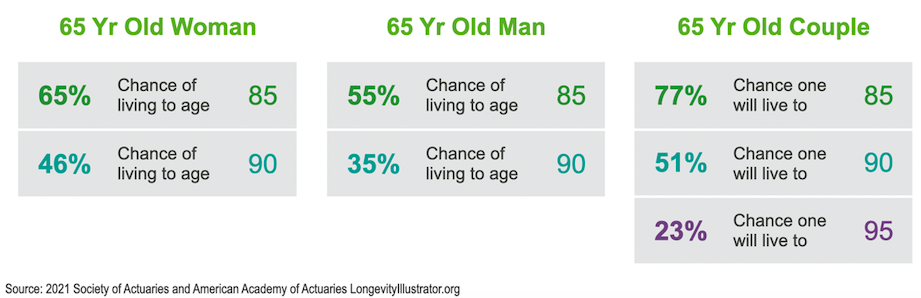

Life expectancy is a key factor in estimating how long retirement savings need to last. Advances in healthcare and lifestyle changes have increased life expectancy, making it essential for retirees to plan for a potentially longer retirement period.

2.Retirement Savings:

The initial amount of savings at the time of retirement is a critical input. This includes contributions to retirement accounts such as 401(k)s, IRAs, and other investments. The higher the initial savings, the longer it may last during retirement.

3.Inflation:

Inflation erodes the purchasing power of money over time. Retirees must account for the rising cost of living when estimating how long their savings will last. Failure to consider inflation can result in underestimating future expenses.

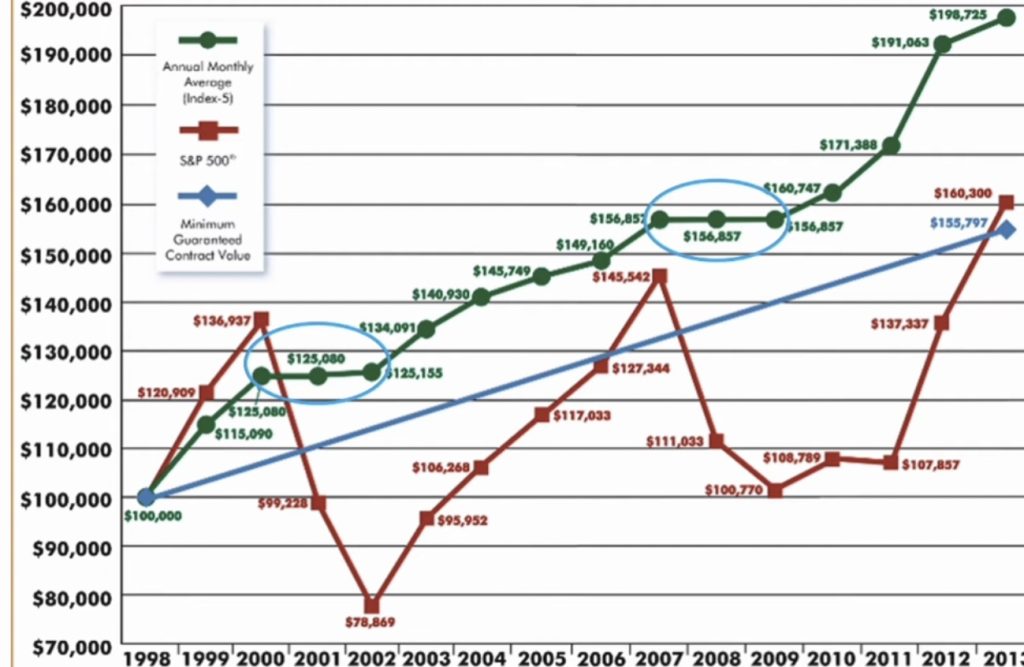

4.Investment Returns:

The returns on invested assets play a crucial role in sustaining retirement funds. A diversified investment portfolio can help mitigate risks, but fluctuations in the market can impact the overall value of the retirement savings.

5.Spending Habits:

The lifestyle choices and spending habits of retirees directly influence the rate at which savings are depleted. Prudent financial management and budgeting are essential to ensure sustainable spending throughout retirement.

Retirees’ Greatest Fear: Running Out of Money:

The fear of running out of money before death is rooted in the potential consequences of financial insufficiency during retirement. Several factors contribute to this anxiety:

1.Increased Healthcare Costs:

As individuals age, healthcare expenses often rise. The need for medical care, medications, and potential long-term care can strain finances, especially if not adequately planned for.

2.Limited Earning Opportunities:

Unlike their working years, retirees have limited opportunities to supplement their income. Relying solely on fixed pensions and savings can leave them vulnerable to unexpected expenses.

3.Market Volatility:

Economic downturns and market volatility can significantly impact the value of investments, potentially depleting retirement savings faster than anticipated.

4.Longevity Risk:

With increasing life expectancy, retirees face the challenge of ensuring their savings last throughout a potentially extended retirement period. Outliving one’s savings can result in financial hardship in the later stages of life.

Conclusion:

“Age Savings Run Out” is a critical metric that retirees must carefully calculate to navigate the complexities of retirement planning. The fear of running out of money before death underscores the need for meticulous financial planning, early consideration of healthcare costs, and a realistic assessment of lifestyle choices. By understanding the factors influencing this fear, retirees can take proactive steps to secure their financial well-being and enjoy a comfortable and worry-free retirement.

The follow-up article will show how an IUL(indexed Universal Life) can help you be successful when dealing with increased healthcare costs, limited earning opportunities, market volatility and longevity risks.