"Optimizing Wealth: 10 Compelling Reasons to Choose Indexed Universal Life Over Traditional Savings Accounts"

1. **Indexed Returns:** In an Indexed Universal Life (IUL) policy, your savings aren’t tied to fixed interest rates like in a bank account. Instead, they are linked to the performance of a stock market index. This potential for higher returns can outpace the interest earned in a traditional bank savings account.

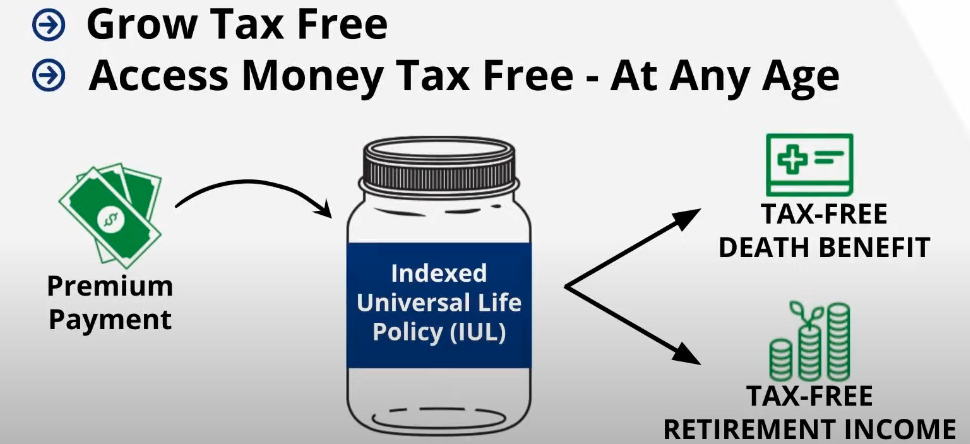

2. **Tax Advantages:** IULs offer tax advantages that bank accounts typically don’t. The growth of your cash value in an IUL is generally tax-deferred, meaning you only pay taxes on the gains when you withdraw them, providing potential tax savings compared to a taxable bank account.

3. **Guaranteed Minimum Interest Rate:** Most IUL policies provide a guaranteed minimum interest rate, ensuring that even in market downturns, your cash value will continue to grow. This feature provides a level of security that is not present in many traditional savings accounts.

4. **Downside Protection:** IUL policies often come with a floor, protecting your cash value from market downturns. Unlike the potential loss in the stock market, your savings in an IUL won’t decrease below a certain level, providing a safety net for your investment.

5. **Flexibility in Premiums:** IULs offer flexibility in premium payments. While a bank account may only allow you to deposit a fixed amount, an IUL allows you to adjust your premium payments within certain limits, providing financial flexibility that aligns with your changing needs.

6. **Permanent Life Insurance Coverage:** Besides being a savings vehicle, an IUL provides life insurance coverage. This dual benefit ensures that your loved ones are financially protected in the event of your passing, offering peace of mind that a traditional bank account cannot provide.

7. **Access to Cash Value:** IULs allow you to access the cash value of your policy through loans or withdrawals. This liquidity can be beneficial in emergencies or for other financial needs, offering a level of financial flexibility that might not be available with a bank savings account.

8. **Diversification:** By linking your savings to the performance of an index, IULs provide a form of diversification not found in a bank account. This diversification can potentially lead to more stable and robust long-term growth.

9. **No Contribution Limits:** While traditional savings accounts may have contribution limits, IULs generally do not impose such restrictions. This allows you to contribute more towards your financial goals without facing limitations that could hinder your savings potential.

10. **Estate Planning Benefits:** IULs can offer advantages in estate planning, providing a tax-efficient way to pass wealth to beneficiaries. This feature adds an extra layer of financial planning that may not be present with a standard bank savings account.

In summary, an Indexed Universal Life policy offers a combination of growth potential, tax advantages, downside protection, and flexibility that can make it a safer and more versatile option for savings compared to a traditional bank account.