"11 Signs You Will Be Able To Live Off Your Retirement Nest Egg"

As you approach retirement, the question of whether your nest egg is sufficient to sustain your lifestyle becomes paramount. Identifying signs that indicate you are well-prepared is crucial for a smooth transition into this new phase of life. In this article, we explore 11 clear signs that suggest you are on the right track to live comfortably off your retirement nest egg.

1. **Adequate Savings Growth:**

If your retirement savings have experienced consistent and healthy growth over the years, it’s a positive indicator that your nest egg is positioned to support your needs.

2. **Diversified Investment Portfolio:**

A well-diversified investment portfolio minimizes risks and enhances stability. If your retirement savings are spread across various assets, you are better positioned to weather market fluctuations.

3. **Emergency Fund in Place:**

An emergency fund outside your retirement savings signals financial prudence. This safety net provides a buffer against unexpected expenses, ensuring your nest egg remains intact for your planned retirement expenses.

4. **Minimal Debt Load:**

A manageable level of debt or, ideally, being debt-free is a positive sign. Entering retirement without the burden of significant debts allows you to allocate more of your resources to enjoying your retirement years.

5. **Living Below Your Means:**

If your lifestyle has consistently been below your means, it indicates financial discipline. This habit positions you favorably for retirement, as you are accustomed to managing your expenses effectively.

6. **Detailed Retirement Budget:**

A well-constructed retirement budget demonstrates a proactive approach to managing your finances. Knowing your anticipated expenses allows for better planning and allocation of your nest egg.

7. **Understanding Social Security Benefits:**

Having a clear understanding of your Social Security benefits and how they align with your retirement income plan is crucial. Maximizing these benefits contributes to the overall sustainability of your nest egg.

8. **Healthcare Preparedness:**

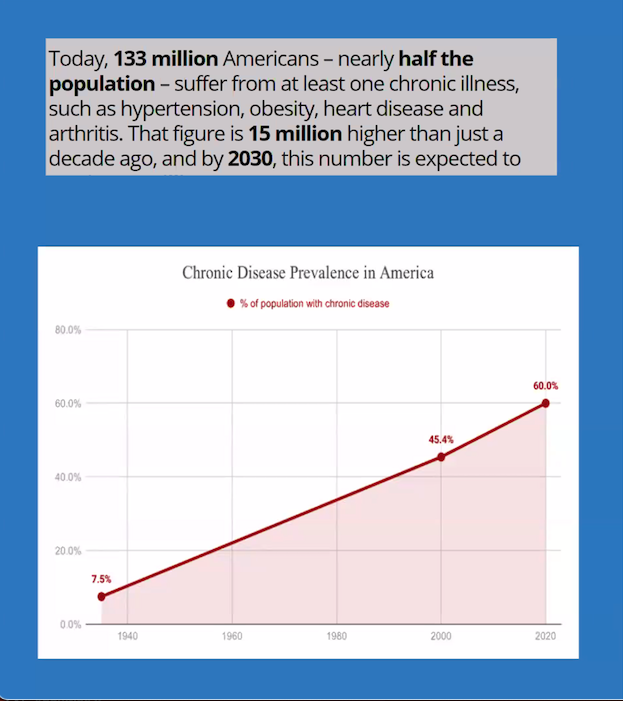

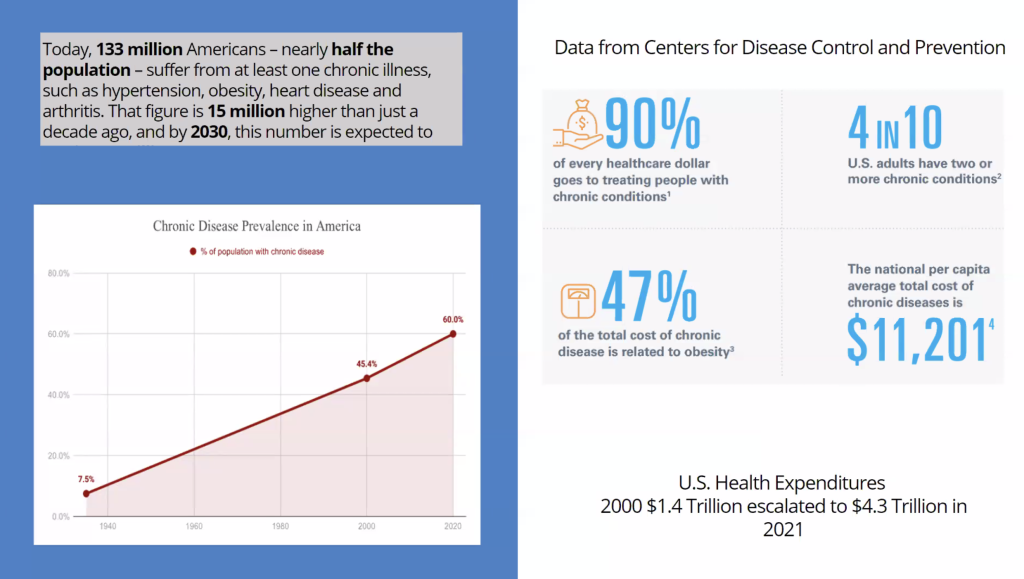

Adequate preparation for healthcare costs is a significant sign of retirement readiness. If you’ve factored in potential medical expenses and have a plan in place, it adds a layer of security to your nest egg.

9. **Long-Term Care Considerations:**

Thinking about long-term care needs and having a strategy in place, such as insurance coverage, demonstrates foresight. This helps protect your nest egg from potential challenges associated with health-related expenses.

10. **Regular Financial Check-Ups:**

Regularly reviewing and adjusting your retirement plan shows adaptability to changing circumstances. This ongoing assessment ensures that your nest egg remains aligned with your evolving needs.

11. **Exploration of Living Benefit Options, Like IUL:**

Investigating financial instruments that offer living benefits, such as Indexed Universal Life (IUL), is a forward-thinking move. IUL not only provides life insurance coverage but also offers living benefits that can assist with health-related challenges during retirement.

Conclusion:

In the complex landscape of retirement planning, the signs mentioned above provide a roadmap for assessing your preparedness. Additionally, considering financial tools like Indexed Universal Life (IUL) with living benefits can be a strategic move. IUL not only safeguards your loved ones with life insurance but also addresses health-related challenges by providing access to funds in case of critical illness or long-term care needs. This dual benefit enhances your financial security, ensuring that your retirement nest egg is well-equipped to handle the uncertainties that may arise during your golden years.