Empowering Gen Z and Millennials with Cutting-Edge Financial Solutions: Unveiling the Benefits of IUL

In today’s fast-paced financial landscape, it’s imperative for younger generations to grasp the potential of state-of-the-art financial tools. Explore how the Indexed Universal Life (IUL) insurance policy is gaining momentum as a groundbreaking solution. Let’s dissect the intricacies and unveil how this can revolutionize the financial game for Gen Z and Millennials, all while tackling the challenges faced by baby boomers.

**Understanding the IUL:**

The IUL isn’t your run-of-the-mill insurance policy; it’s a dynamic financial instrument fusing life insurance coverage with lucrative investment opportunities. Crafted for the tech-savvy and forward-thinking, this innovative approach empowers policyholders to accrue cash value over time.

**Why Gen Z and Millennials should take notice:**

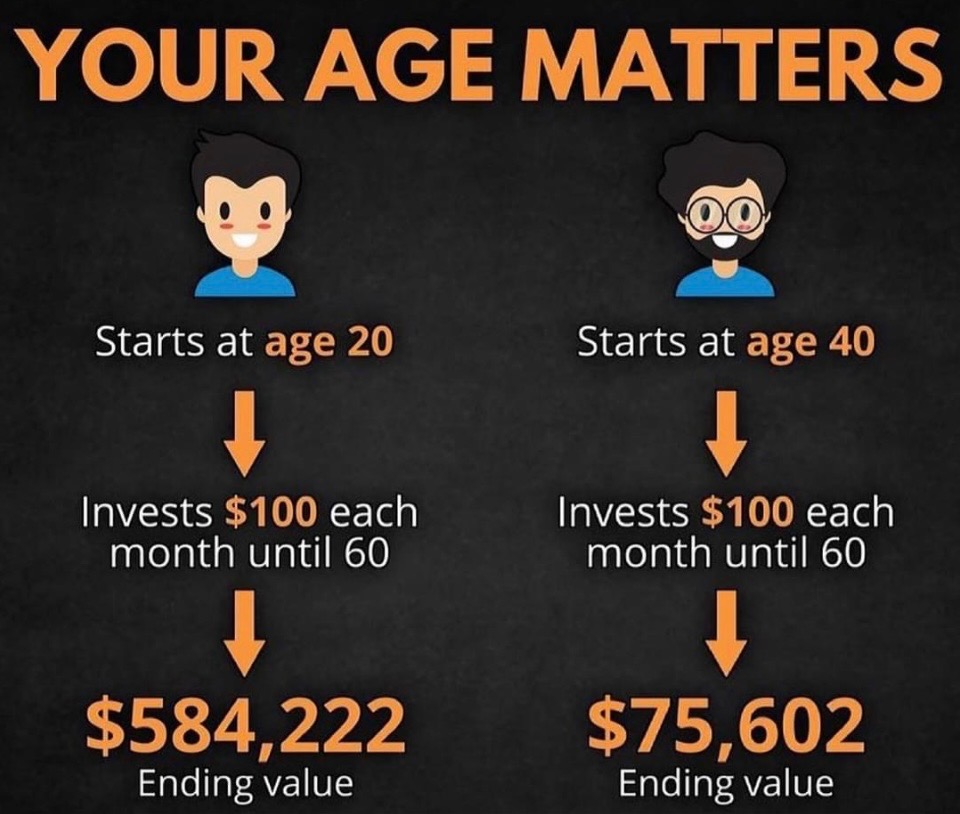

For a generation synonymous with embracing change, the IUL aligns seamlessly with their values. It offers a distinctive path for long-term wealth accumulation, delivering the flexibility that resonates with the unpredictable nature of their lives. Diverging from traditional retirement plans, the IUL permits tax-free withdrawals during retirement, becoming a formidable tool for achieving financial independence.

**Living Benefits:**

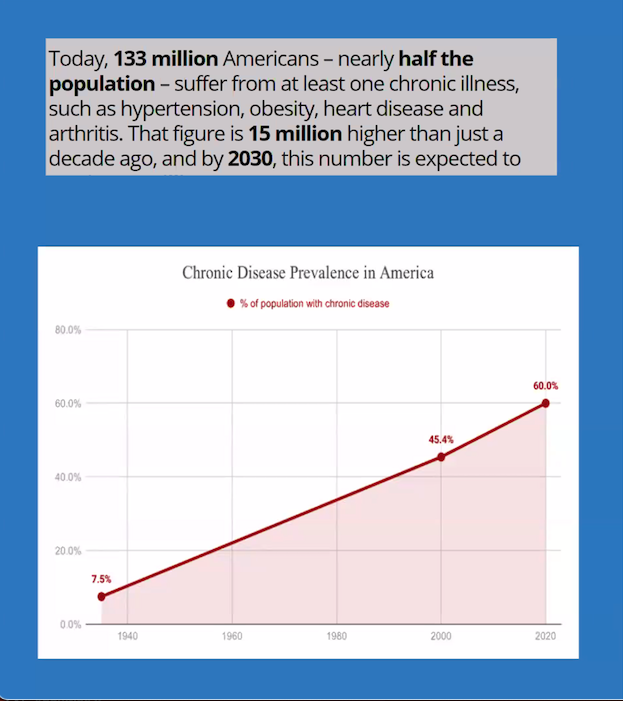

What sets the IUL apart? Living benefits. In a world where unforeseen circumstances can derail financial plans, the IUL offers living benefits accessible in times of need. Whether confronting a critical illness or disability, policyholders can tap into the cash value to cover medical expenses or augment income. This strongly resonates with the risk-averse nature of Gen Z and Millennials, prioritizing financial security and peace of mind.

**Addressing Baby Boomer Challenges:**

Now, let’s revisit the baby boomers. Many grapple with retirement planning and healthcare costs’ complexities. The IUL emerges as a solution, providing tax-free retirement income and living benefits to significantly alleviate their financial burdens. It’s not solely about securing the future; it’s a pragmatic remedy for the challenges they face today.

In conclusion, the IUL transcends being just an insurance policy; it’s a strategic financial weapon for the modern generation. Gen Z and Millennials can leverage its unique features to navigate life’s uncertainties, offering a lifeline for baby boomers seeking relief from retirement challenges. The IUL stands as a beacon of financial empowerment, aligning seamlessly with the values and needs of today’s dynamic and future-focused individuals.