Will Interest Rates Go Below 6% in 2024?

The mortgage industry is expected to see positive trends in 2024, with Fannie Mae’s Economic & Housing Outlook predicting a drop in 30-year mortgage rates below 6% by the year-end. This anticipated moderation in rates is considered healthy when compared to historical data, where rates in 1971 exceeded 7%, and the 1980s experienced rates over 18%.

As rates decrease, housing affordability is gradually improving, although challenges persist for many households. Factors such as insufficient incomes, rising homeowners insurance rates, and inflation-related costs continue to impact affordability. Despite the drop in average mortgage payments from $2,361 in December 2023 to $2,034 in October, only 15.5% of homes were affordable for the average American household in 2023, marking a decline from the 20.7% affordability in 2022.

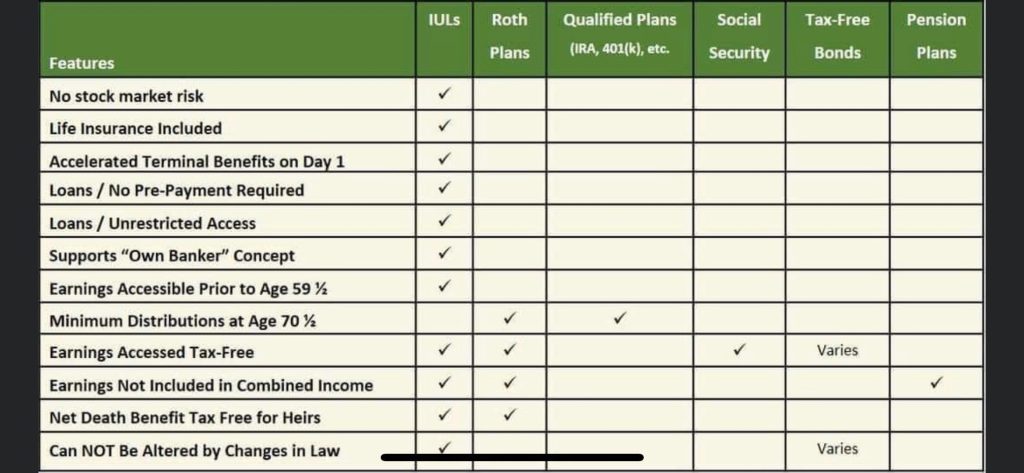

Additionally, incorporating an Indexed Universal Life (IUL) policy provides a unique advantage in building tax-free savings, coupled with the flexibility of tax-free withdrawals through a loan without penalties. This parallels the benefits seen in 401(k) and qualified plans but offers greater adaptability. This financial tool allows individuals to strategically leverage their savings for purposes such as a down payment on a house or initiating a business, showcasing the flexibility that an IUL brings to financial planning.