A Candid Look at Financial Advisors: Warren Buffett's Perspective and the Impact on Retirement Savings

When it comes to securing your financial future and retirement savings, having a financial advisor can be a game-changer. But it’s not all rainbows and butterflies. You see, Warren Buffett, the investment guru, thinks there’s a twist to this story. Let’s dive into what he’s got to say about financial advisors, the tricky issues that can come up, and how they can mess with your retirement money – especially when they start talking about management fees.

Warren Buffett’s Take on Financial Advisors

Warren Buffett, the big boss at Berkshire Hathaway and one of the smartest money minds in history, has a thing or two to say about financial advisors. He’s not one to mince words, and his thoughts are pretty eye-opening.

In plain words, Buffett isn’t entirely convinced that many financial advisors are worth their salt. He once said, “It’s like expecting someone to explain why they’re not really doing much to help you. To be blunt, it’s like monkeys throwing darts.” Ouch, right? What he means is that some advisors might not be worth the fees they charge, and you might do just as well handling your investments yourself.

Conflicts of Interest in the Financial Advisory World

One of the red flags Warren Buffett raises is the potential for conflicts of interest in the financial advisory world. You see, many advisors work on a commission-based model. They make money based on what they sell you, not necessarily what’s best for you. So, they could recommend something that’s good for them but not so great for your wallet.

For instance, an advisor might push a high-fee mutual fund or insurance policy because it fattens their wallet, not because it’s the best choice for you. This misalignment of interests can mess with your financial health, especially when you’re talking about retirement plans.

How Management Fees Can Hit Your Retirement Savings

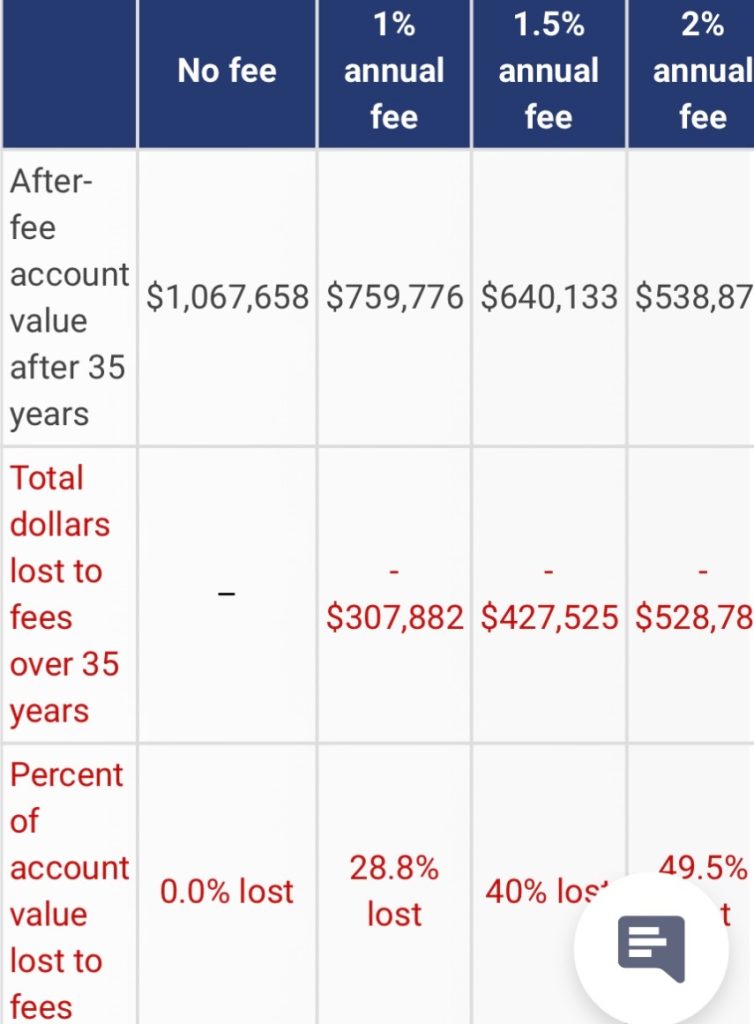

Here’s another shocker Warren Buffett throws at us – management fees. When you hire a financial advisor, they typically charge you an annual fee, usually around 1% to 3.5% of the money they’re managing for you. Seems small, right? Well, hold on.

Let’s say you invest $100,000 for your retirement, and your advisor charges a 2% annual management fee. Over 30 years, even with a decent 7% return before fees, those management fees will eat up roughly $108,000. That’s more than your initial investment would’ve earned if there were no fees involved. So, management fees can seriously dent your retirement fund in the long run.

Enter Passive Investing

Warren Buffett has a different strategy in mind, one that’s been gaining steam lately – passive investing. It’s like setting your money on autopilot. Instead of trying to outsmart the market, you invest in low-cost index funds or ETFs and let your money ride the market’s wave.

Buffett’s all for this approach because it’s cost-effective and reliable. It’s about holding onto your investments for the long haul and not fussing over daily market drama. It aligns with his philosophy of buying into solid companies and keeping them in your portfolio.

Compound Interest Magic

Another thing Buffett likes to remind us about is the magic of compound interest. He’s famously said, “My wealth has come from a combination of living in America, some lucky genes, and compound interest.” It’s like money making money all by itself. But if you’re losing a chunk to high fees, that magic can fade away.

For example, if you’re earning 7% annually on your investments but paying a 2% management fee, your real gain is just 5%. Over the years, that seemingly small difference can translate into big losses. Buffett’s point is to keep fees low and let compound interest do its thing.

Fiduciary Duty and Being in the Know

To tackle these problems, there have been some rule changes in the financial advisory world. They introduced something called the “fiduciary duty,” which means advisors have to put your interests first. But here’s the kicker – not all advisors have to follow this rule.

Buffett stresses the need for transparency and full disclosure about fees and potential conflicts of interest. You’ve got to know how your advisor makes money and whether they’re really looking out for you. Ask questions, find advisors who are fiduciaries, and watch out for the ones who might prioritize their wallet over yours.

In Conclusion

Warren Buffett’s wake-up call is clear: be cautious about conflicts of interest, understand how management fees can eat into your retirement savings, consider passive investing, embrace the power of compound interest, and make sure your advisor has your back.

The takeaway here is simple: while there are many good financial advisors out there, it’s essential to be aware of these financial pitfalls. Buffett’s advice is to keep fees low and align your interests with your advisor’s. By being informed and making smart choices, you can better secure your financial future and retirement savings.