A Commentary on Yahoo Finance Article: “Social Security Cuts: Ways Boomers Should Prepare for the Upcoming Cost of Living Adjustment Changes"

In the article by Yahoo Finance

“Social Security Cuts: Ways Boomers Should Prepare for the Upcoming Cost of Living Adjustment Changes”

one of the recommendations is returning to work or continuing to work longer by postponing retirement.

We think you’d agree that “working longer” wasn’t part of the retirement plan most had in mind.

Are there some lessons to be learned from this problem if your not a Boomer?

Definitely!

Are you in your prime working years, bustling through life, and maybe not giving too much thought to your retirement?

Well, here’s a wake-up call: retirement planning isn’t just for seniors anymore. The challenges our baby boomer counterparts are facing now should serve as a warning sign for us. Why? Because if we don’t plan wisely, we might find ourselves in the same predicament.

So, what’s the buzz about? It’s all about Social Security and those 401(k) plans we’ve been contributing to. Brace yourselves, because here’s what’s happening:

Social Security Squeeze: In 2024, the cost-of-living adjustment (COLA) for Social Security is expected to shrink drastically, by more than half, due to falling inflation rates. Now, you might think this doesn’t affect you, but if you plan to retire someday, it does. This reduced COLA could mean our future Social Security checks won’t stretch as far as we’d hoped.

The Reality Check: So, why should you care? Well, let’s fast forward to your retirement years. Imagine you’ve worked hard, saved up in your 401(k), and expected Social Security to be a safety net. But if that net gets a lot smaller, what’s your plan B?

Here are some takeaways for us young and not-so-senior folks:

- Trim the Fat: Start thinking about your expenses now. Downsizing, budgeting, and hunting for discounts aren’t just for your grandparents. These habits can free up more cash for your future.

- Tame the Debt Dragon: High-interest debts like credit cards or student loans can haunt you during retirement. Paying them off now means more money in your pocket later.

- Build That Safety Net: Emergencies don’t care if you’re retired. Start building an emergency fund. Three to six months’ worth of living expenses can save you from future financial stress.

- Don’t rely solely on Social Security and your 401(k). It’s about diversifying and building income streams beyond your day job.

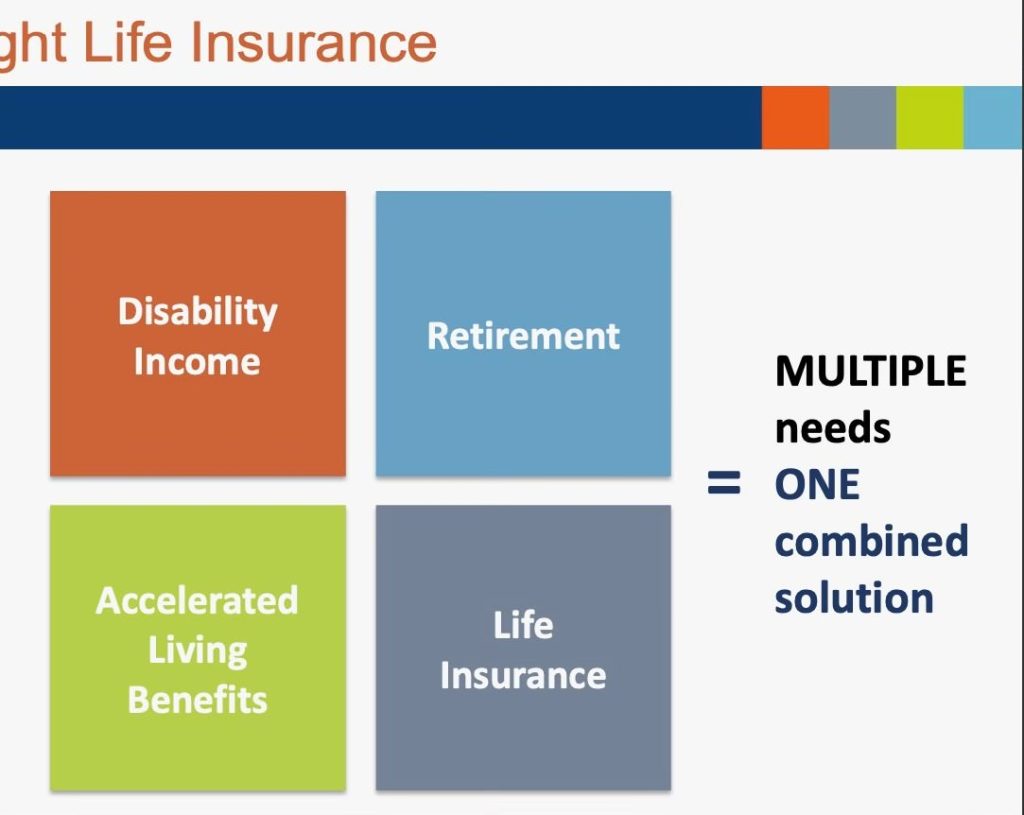

But here’s a golden nugget to consider: Indexed Universal Life (IUL) insurance. This isn’t just about leaving something behind for loved ones; it’s about securing your future too. The best part? The income from an IUL is tax-exempt. Translation: it won’t shrink your Social Security payments when you retire. Not to mention the built in Living Benefits that can be triggered for health problems such as: Chronic, Critical or Terminal Events. It can even act as a disability insurance in case of injury and take care of expenses if the injury is chronic or requires longer term care.

So, what’s the bottom line? Don’t wait until retirement to tackle these issues. Start planning now to ensure that your golden years are truly golden. Be proactive, get advice from experts, and you’ll thank your younger self when you’re living comfortably in retirement without needing to clock back in at the office.

(Link to the article