America's Looming Crisis in Retirement Savings: A Call to Action

As we progress into the 21st century, America finds itself at a critical juncture concerning retirement savings. A growing body of research indicates that we are on the precipice of a crisis, with a significant portion of the population ill-prepared for their golden years. The numbers paint a stark picture: Census data reveals that fewer than half of Americans have retirement accounts, and even among those nearing retirement age, the percentage with such accounts remains distressingly low, hovering below 60% as of 2020.

The Reality of Retirement Income Disparity:

For many Americans, retirement savings are synonymous with Social Security benefits. However, the harsh reality is that Social Security alone is woefully inadequate to sustain a comfortable retirement. The average monthly Social Security check in 2023 amounted to approximately $1,800. Contrast this with the typical monthly expenses of households headed by individuals aged 65 or older, which stood at $4,345 according to an analysis by BlackRock using federal statistics. This glaring disparity underscores the urgent need for Americans to bolster their retirement savings outside of Social Security.

Factors Contributing to the Crisis:

Several factors have converged to exacerbate the retirement savings crisis in America:

- Stagnant Wages: Despite overall economic growth, wages for many workers have remained stagnant or have not kept pace with the rising cost of living. This makes it increasingly challenging for individuals to set aside funds for retirement amidst competing financial obligations.

- Decline of Traditional Pensions: Traditional pension plans, which provide a guaranteed income stream in retirement, have become increasingly rare in the private sector. Instead, many employers have shifted towards defined-contribution plans, such as 401(k)s, placing the onus of retirement planning squarely on the individual.

- Rising Healthcare Costs: Healthcare expenses represent a significant portion of retirees’ budgets, and the soaring costs of medical care can quickly deplete retirement savings. Without adequate preparation, retirees may find themselves facing financial hardship due to unexpected healthcare expenses.

- Longer Lifespans: With advancements in healthcare and medical technology, Americans are living longer than ever before. While increased longevity is undoubtedly a positive development, it also means that retirees must stretch their savings over an extended period, heightening the risk of outliving their assets.

The Urgent Need for Action:

Addressing the looming crisis in retirement savings requires a multi-faceted approach involving policymakers, employers, financial institutions, and individual savers:

- Policy Reforms: Policymakers Asmust enact reforms aimed at expanding access to retirement savings vehicles, enhancing Social Security benefits, and incentivizing employers to provide retirement benefits to their workers.

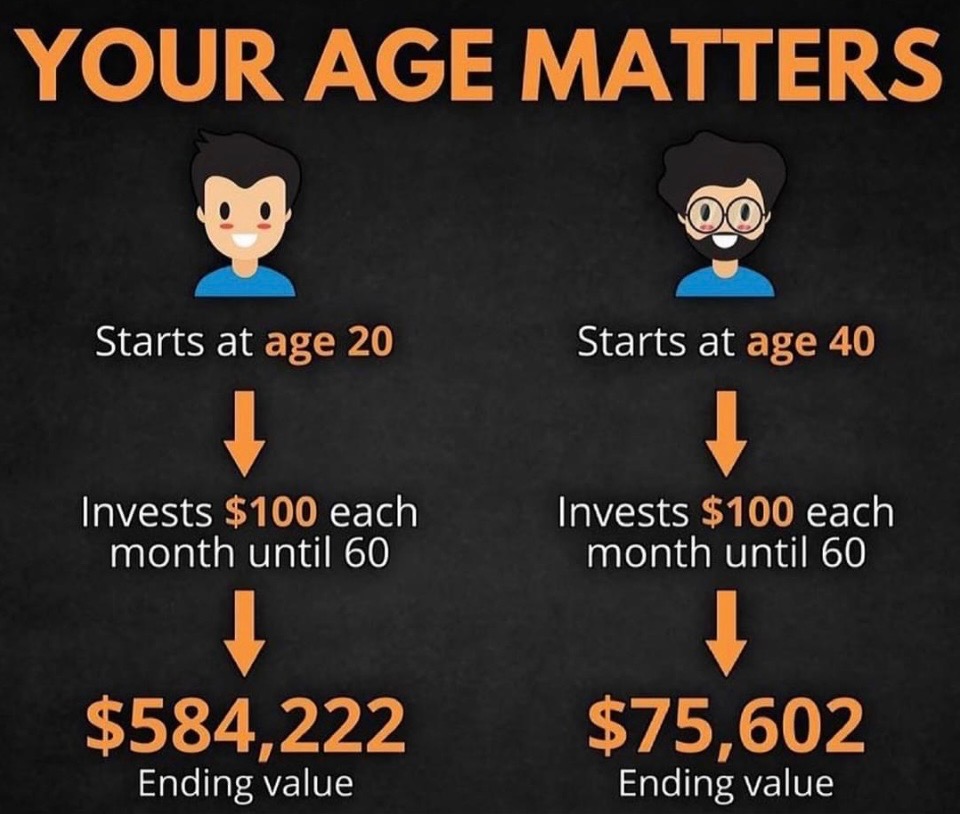

- Financial Education and Awareness: Empowering individuals with financial literacy and knowledge about retirement planning is crucial. Educational initiatives can help people understand the importance of saving for retirement early and the various investment options available to them.

- Employer Involvement: Employers play a pivotal role in facilitating retirement savings for their employees. Offering employer-sponsored retirement plans, providing matching contributions, and offering financial wellness programs can encourage employees to save for retirement.

- Personal Responsibility: Ultimately, individuals bear the responsibility for their own retirement security. It’s imperative for individuals to prioritize saving for retirement, even amid competing financial demands, and to seek professional guidance to develop a comprehensive retirement plan tailored to their needs and goals.

Conclusion:

The crisis in retirement savings facing America is not insurmountable, but it demands immediate attention and concerted action from all stakeholders. By implementing policy reforms, promoting financial education, engaging employers, and encouraging personal responsibility, we can work towards ensuring that all Americans have the opportunity to enjoy a financially secure and dignified retirement. The time to act is now, lest we consign future generations to a retirement plagued by uncertainty and financial hardship.