Boosting Retirement Income: The Case for Using an IUL to Preserve Social Security Benefits

As individuals plan for their golden years, a common concern arises: will retirement plan withdrawals impact social security benefits? The short answer is yes, but the degree to which they affect your benefits can be mitigated through strategic financial planning. One powerful tool to consider in this regard is the Indexed Universal Life (IUL) insurance policy.

Understanding the Social Security Benefit Formula

To grasp the potential impact of retirement plan withdrawals on Social Security benefits, it’s essential to understand the benefit calculation formula. The Social Security Administration considers your Average Indexed Monthly Earnings (AIME) to determine your Primary Insurance Amount (PIA). AIME is based on your highest-earning 35 years, adjusted for inflation.

Here’s where retirement plan withdrawals come into play. Taxable withdrawals from retirement accounts contribute to your overall income, affecting the AIME and subsequently, the PIA. Higher income may lead to higher taxes on your Social Security benefits, reducing the net amount you receive.

The Role of an IUL in Mitigating Impact

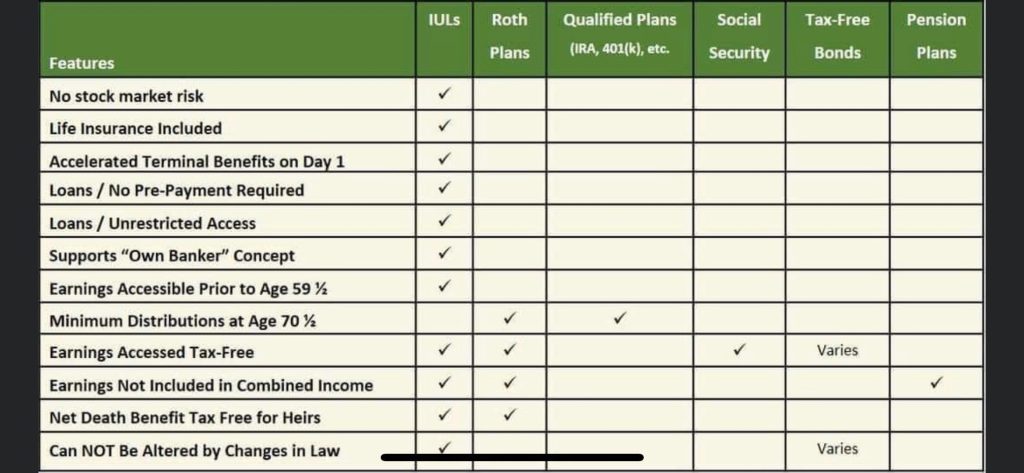

Indexed Universal Life insurance emerges as a compelling solution to mitigate the impact of retirement plan withdrawals on Social Security benefits. An IUL provides a dual benefit of life insurance coverage and a cash value component, which grows based on market indexes. Here’s how it works:

Tax-Advantaged Growth: The cash value within an IUL grows tax-deferred. Unlike traditional retirement accounts subject to required minimum distributions (RMDs), an IUL allows you to access the cash value without triggering taxable events.

Flexible Withdrawals: With an IUL, you have flexibility in accessing funds. By strategically withdrawing from the cash value instead of taxable retirement accounts, you can manage your income to stay within optimal tax brackets, potentially minimizing the impact on Social Security benefits.

No Impact on Social Security Calculations: Withdrawals from the cash value of an IUL don’t contribute to your AIME. Therefore, they won’t directly affect your Social Security benefits, providing a level of financial maneuverability to enhance your retirement income.

Conclusion

In navigating the complexities of retirement planning, it’s crucial to consider the broader impact of income sources on your overall financial picture. An Indexed Universal Life insurance policy offers a strategic avenue to preserve Social Security benefits while providing financial security through life insurance coverage. By leveraging the tax advantages and flexibility of an IUL, individuals can optimize their retirement income strategy, ensuring a more comfortable and financially stable post-work life.