Comparing Costs: Senior Care Plans vs IUL with Living Benefits

When considering the financial aspects of providing care for seniors with chronic or terminal illnesses or injuries, it’s evident that senior care plans can often be more expensive than the Living Benefits provided by Indexed Universal Life (IUL) insurance policies. These Living Benefits, offered by IUL policies, present a cost-effective alternative for addressing the challenges of long-term care.

Premiums and Costs:

- Senior Care Plans: Traditional senior care plans often require significant monthly or annual premiums. These premiums can escalate based on the level of coverage, the senior’s age, and their health condition. As seniors grow older or require more comprehensive care, premiums tend to rise substantially.

- IUL Policies with Living Benefits: IUL policies typically have premiums that remain stable over time. While IUL policies require premium payments, the potential cost savings become evident when considering the comprehensive coverage provided by Living Benefits.

Coverage and Flexibility:

- Senior Care Plans: While senior care plans offer coverage for medical care and long-term services, they may come with limitations and exclusions. Certain services or conditions might not be fully covered, leading to unexpected out-of-pocket expenses.

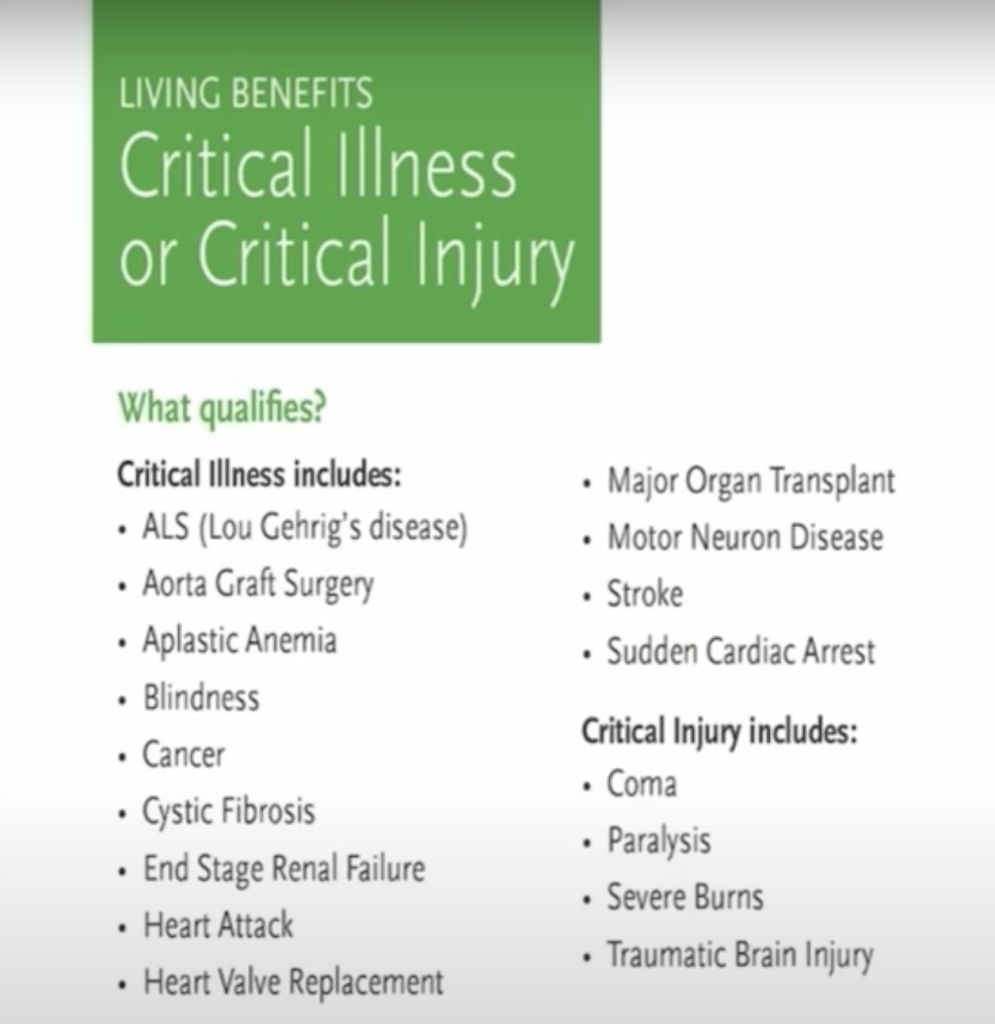

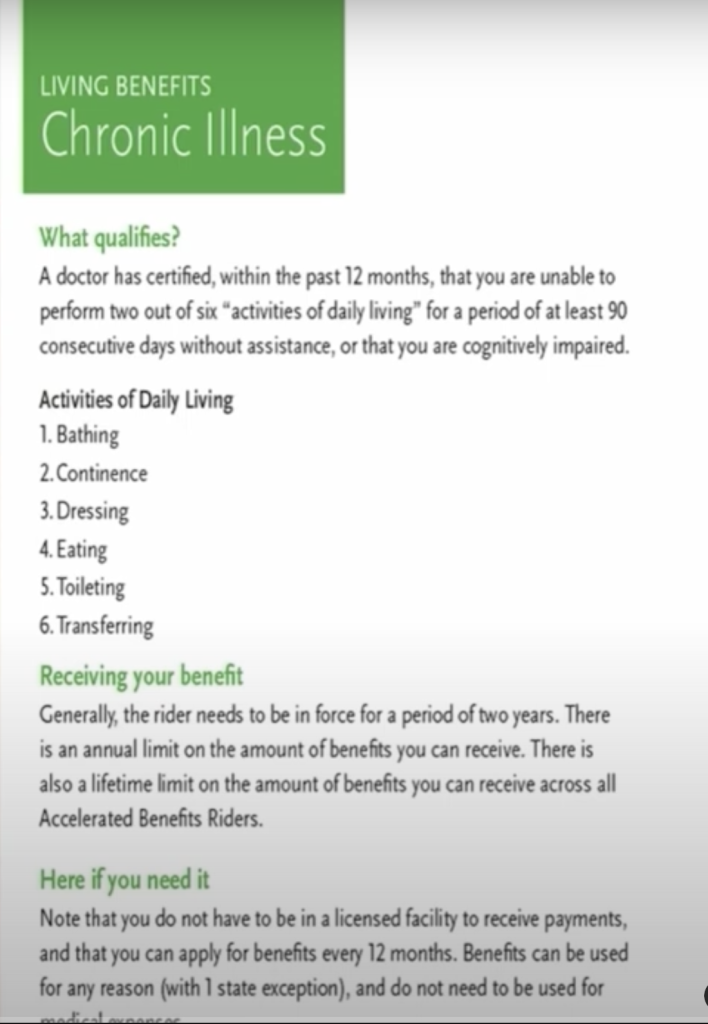

- IUL Policies with Living Benefits: Living Benefits in IUL policies offer a broader scope of coverage for both chronic and terminal illnesses or injuries. These benefits can encompass medical treatments, home care, hospice care, assisted living, and more. The flexibility of these benefits helps policyholders tailor their care based on their unique needs

Comparing Costs: Senior Care Plans vs. Living Benefits in IUL Policies

When considering the financial aspects of providing care for seniors with chronic or terminal illnesses or injuries, it’s evident that senior care plans can often be more expensive than the Living Benefits provided by Indexed Universal Life (IUL) insurance policies. These Living Benefits, offered by IUL policies, present a cost-effective alternative for addressing the challenges of long-term care.

Premiums and Costs:

- Senior Care Plans: Traditional senior care plans often require significant monthly or annual premiums. These premiums can escalate based on the level of coverage, the senior’s age, and their health condition. As seniors grow older or require more comprehensive care, premiums tend to rise substantially.

- IUL Policies with Living Benefits: IUL policies typically have premiums that remain stable over time. While IUL policies require premium payments, the potential cost savings become evident when considering the comprehensive coverage provided by Living Benefits.

Coverage and Flexibility:

- Senior Care Plans: While senior care plans offer coverage for medical care and long-term services, they may come with limitations and exclusions. Certain services or conditions might not be fully covered, leading to unexpected out-of-pocket expenses.

- IUL Policies with Living Benefits: Living Benefits in IUL policies offer a broader scope of coverage for both chronic and terminal illnesses or injuries. These benefits can encompass medical treatments, home care, hospice care, assisted living, and more. The flexibility of these benefits helps policyholders tailor their care based on their unique needs.

Benefit Accessibility:

- Senior Care Plans: Senior care plans often require seniors to meet specific criteria or “benefit triggers” before they can access coverage. This can delay the receipt of essential care, especially when the senior’s health deteriorates rapidly.

- IUL Policies with Living Benefits: Living Benefits from IUL policies can be accessed more quickly, providing timely financial support when needed. This swift access ensures that seniors can receive necessary care without undue delay.

Long-Term Savings:

- Senior Care Plans: Over time, the cumulative premiums paid for senior care plans can become a significant financial burden, especially when factoring in potential premium increases.

- IUL Policies with Living Benefits: IUL policies offer the potential for accumulating cash value over time, which can be used to offset future premium payments or provide additional financial support for care needs. Plus with Living Benefits for Chronic or Critical care the death benefit can be accelerated so that the accumulated cash value isn’t depleted. Instead the company’s money is paid directly to the policyholder to be used wherever the policyholder decides.

Financial Stability:

- Senior Care Plans: As seniors age and their health condition changes, the cost of care can escalate significantly, leading to concerns about the stability of financial resources.

- IUL Policies with Living Benefits: Living Benefits provide a level of financial stability by ensuring that policyholders have a predetermined pool of funds available for care needs. This stability can help seniors and their families plan for the future with greater confidence.

In conclusion, when comparing the costs and benefits of senior care plans and Living Benefits provided by IUL policies, the latter emerges as a more cost-effective and comprehensive solution. IUL policies offer stable premiums, broader coverage, faster access to benefits, potential long-term savings, and enhanced financial stability. Seniors and their families should carefully consider these advantages when making decisions about securing financial support for chronic or terminal care needs.