Discover Your Path to Financial Freedom: Indexed Annuities and IULs for Retirement Income"

Financial guru Robert Kiyosaki, renowned for his bestselling book “Rich Dad Poor Dad,” has always stressed the importance of financial education and wealth creation. His core belief revolves around the concept of passive income – the money that flows in without requiring active work. Here, we’ll delve into the six best passive income ideas according to Kiyosaki and explore the unique advantages of indexed annuities and indexed universal life insurance (IUL) as additional income streams, particularly ideal for those aged 25 to 50.

1. **Real Estate Investments**: Kiyosaki advocates real estate investments as a smart way to let your money work for you. By purchasing properties and renting them out, you can establish a steady stream of income. Over time, as property values rise and mortgages decrease, you’ll benefit from rental income and property appreciation. Kiyosaki emphasizes leveraging other people’s money, such as loans, to kickstart your real estate investments.

2. **Dividend Stocks**: Investing in stocks that pay dividends is another avenue for passive income. When you own stocks from companies that offer dividends, you essentially become a shareholder in their profits. Over time, these dividend payments can accumulate and be reinvested or used as income.

3. **Royalties from Intellectual Property**: If you’re a creative soul – an artist, writer, musician, or inventor – you can earn royalties from your intellectual property. This includes books, songs, patents, or any creation for which you receive a percentage of each sale. Though it requires initial effort to create, the subsequent income can flow in passively for years or even decades.

4. **Creating a Business that Operates Without You**: Rather than working in your business, Kiyosaki suggests working on your business. This means establishing systems, hiring the right people, and automating processes so your business can generate income even when you’re not directly involved.

5. **Earning Interest from Lending Money**: Consider lending your money out to earn interest instead of just saving it in a bank. Platforms offering peer-to-peer lending allow you to lend to individuals or small businesses in exchange for interest payments, effectively making your money work for you.

6. **Annuities**: Annuities are agreements where you pay an insurance company and, in return, receive periodic payments in the future. These payments can offer consistent income during retirement. Indexed annuities and indexed universal life insurance (IUL) stand out as passive income sources that offer unique benefits for those planning their retirement.

**Advantages of Indexed Annuities & Indexed Universal Life Insurance**:

1. **Potential for Higher Returns**: Indexed annuities and IULs provide the potential for higher returns compared to traditional fixed annuities. They are linked to the performance of stock market indices, allowing you to benefit from market upswings.

2. **Principal Protection**: One of the significant advantages is that indexed annuities offer a minimum guaranteed interest rate, safeguarding your principal from market downturns. This is particularly appealing for risk-averse investors.

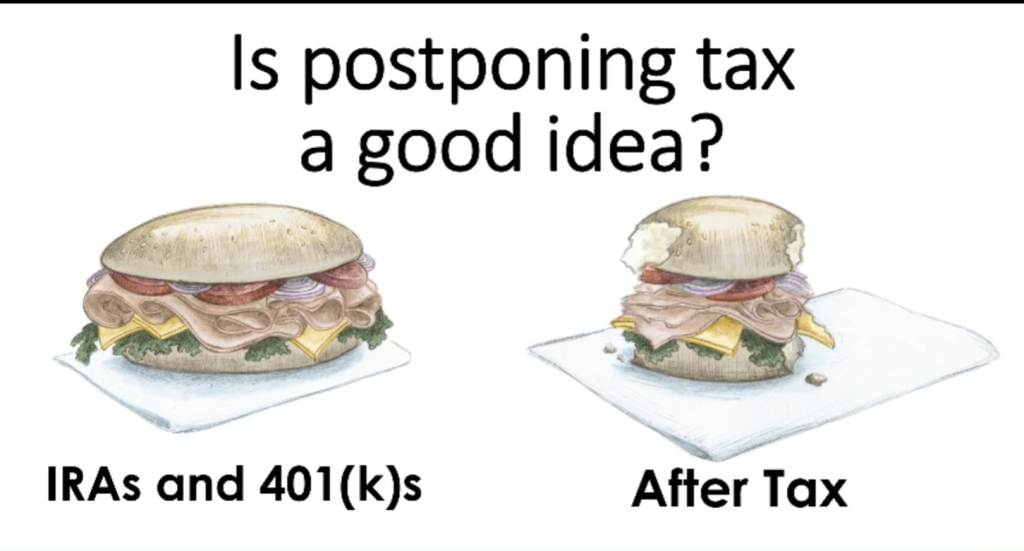

3. **Tax Deferral**: Like other annuities, indexed annuities and IULs offer tax-deferred growth. Taxes are postponed until you start receiving distributions, allowing for potential tax savings over the long term.

4. **Options for Income**: Indexed annuities often provide flexibility, allowing you to choose between periodic income payments or a lump sum. This adaptability is valuable when planning your retirement income strategy.

5. **No Downside Risk**: Unlike variable annuities, indexed annuities and IULs shield you from direct market risk. Even if the market underperforms, your principal is secure, though returns might be limited.

It’s important to acknowledge that some indexed annuities and IULs have their own nuances and limitations, including caps on returns and limited liquidity. Prior to considering these options, it’s crucial to fully understand the differences. Consulting with a licensed professional is strongly recommended to make an informed decision and pave the way for a secure and prosperous retirement. Start building your passive income streams today to secure your financial future.