Don't Delay Millenials & GenZers

With the power of compounding and the many tax advantages, it may make sense to make retirement investing a high priority at any age.

Hey there millennials and Gen Zers! We get it – retirement might seem like a distant galaxy when you’re busy navigating your first real job, enjoying the thrill of marriage, or raising a family. But here’s the scoop: making retirement a financial priority now is a smart move for two big reasons – the magic of compounding and savvy tax management.

Unlock the Magic of Compounding Returns

Ever heard of Albert Einstein? He once dubbed compounding as “the most powerful force in the universe” or even “the eighth wonder of the world.” While we can’t verify if he actually said that, he was onto something big.

Here’s the deal: compounding is like planting a financial seed that grows into a money tree. It happens when the returns you earn on your investments are reinvested, and they start earning returns of their own. Over time, this snowballs into something extraordinary.

Imagine this: you invest $1,000 in something that earns you a cool 5% return, giving you $50 in year one. Now, instead of cashing out, you reinvest it, and your total becomes $1,050. In year two, that $1,050 earns another 5%, which is $52.50, making it $1,102.50. The cycle continues, and each year your earnings grow.

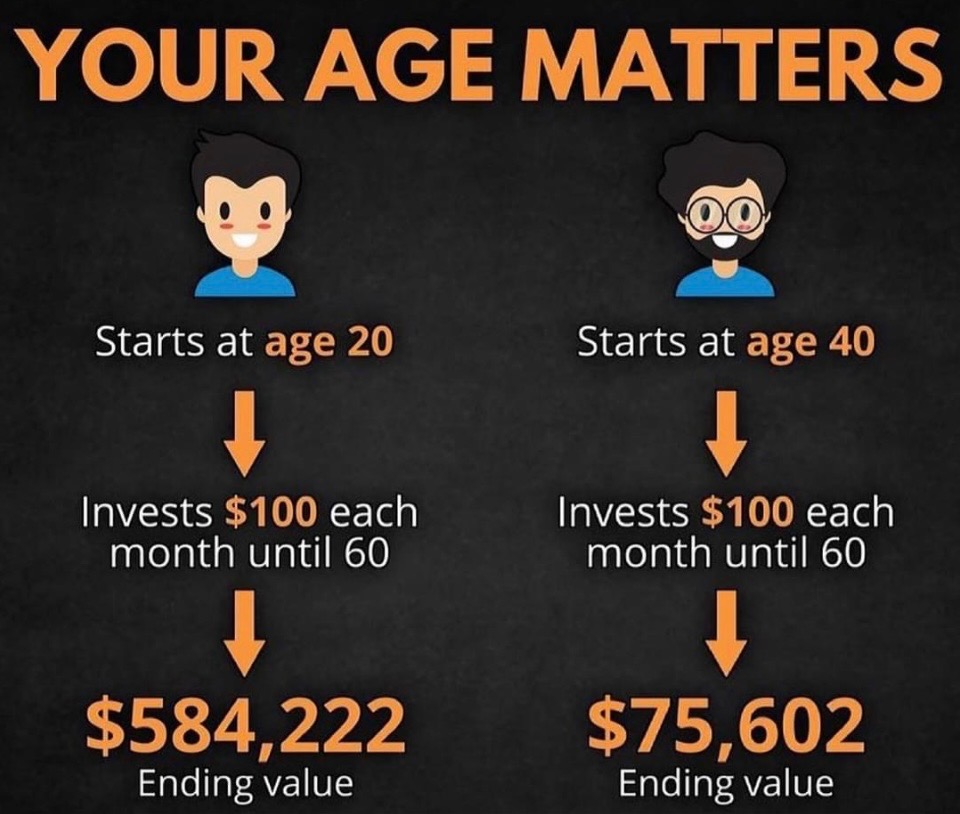

Over the long haul, this snowball effect can lead to impressive wealth. Check out the chart below to see how starting early can make a massive difference.

Now let’s dive into the benefits of using an Indexed Universal Life (IUL) insurance policy as your go-to retirement plan. Picture this as the secret sauce to turbocharge your financial future:

1. Tax-Free Retirement Income for Life:

An IUL is like a Swiss army knife for your retirement strategy. It offers the potential for tax-free retirement income. Here’s how it works: the money you contribute to your IUL policy grows tax-deferred. That means you don’t pay taxes on the gains as they accumulate. When you retire, you can access your policy’s cash value without incurring income taxes. This is like having a golden ticket to a tax-free retirement income for life!

2. Flexibility and Control:

One size doesn’t fit all, and an IUL gets that. It gives you the flexibility to adjust your contributions as your financial situation evolves. Plus, you have control over how your cash value is invested among various index-linked options. You can choose to play it safe or go for potentially higher returns – it’s your call.

3. Living Benefits for Financial Health Issues:

Life can throw curveballs, and health issues can be a major financial threat as you approach retirement. An IUL typically offers living benefits that allow you to access your policy’s cash value if you’re diagnosed with a critical illness or become disabled. This financial lifeline can help you cover medical expenses or replace lost income without dipping into your retirement savings.

4. Penalty-Free Withdrawals When Needed:

Life is unpredictable, and sometimes you need access to your money before retirement age without incurring penalties. With an IUL, you can make withdrawals or take policy loans without facing early withdrawal penalties like you would with traditional retirement accounts. It’s your money, and an IUL gives you the freedom to use it when you need it.

5. Peace of Mind for Your Loved Ones:

Here’s the cherry on top. If the unexpected happens and you pass away, your IUL policy provides a death benefit to your beneficiaries. This financial cushion can help your loved ones cover expenses and maintain their quality of life, all while keeping Uncle Sam out of their pockets with tax-free benefits.

So, in a nutshell, an IUL isn’t just your ordinary retirement plan; it’s a versatile financial tool that offers tax advantages, flexibility, protection against health-related financial crises, and peace of mind for your loved ones. It’s like having your retirement cake and eating it too – all while enjoying the sweet taste of financial securi