Examining the Shift: 401(k) Contributions Decline in 2023 and the Appeal of IUL

In 2023, an unsettling trend has emerged in the realm of retirement savings, as employees across various industries are experiencing a decline in 401(k) contributions from their employers. This shift has prompted individuals to explore alternative options, with Indexed Universal Life (IUL) insurance gaining traction. In this article, we will delve into the statistics highlighting the decrease in 401(k) contributions and discuss the downsides of 401(k) plans compared to the advantages offered by IUL.

The Decline in 401(k) Contributions:

Recent data reveals a concerning dip in employer contributions to employees’ 401(k) plans in 2023. While these contributions have long been a cornerstone of retirement savings, factors such as economic uncertainties, rising healthcare costs, and business challenges have led companies to reevaluate their benefits packages. As a result, employees find themselves shouldering a greater burden when it comes to building their retirement nest eggs.

Downsides of 401(k) Plans:

1. Market Volatility:

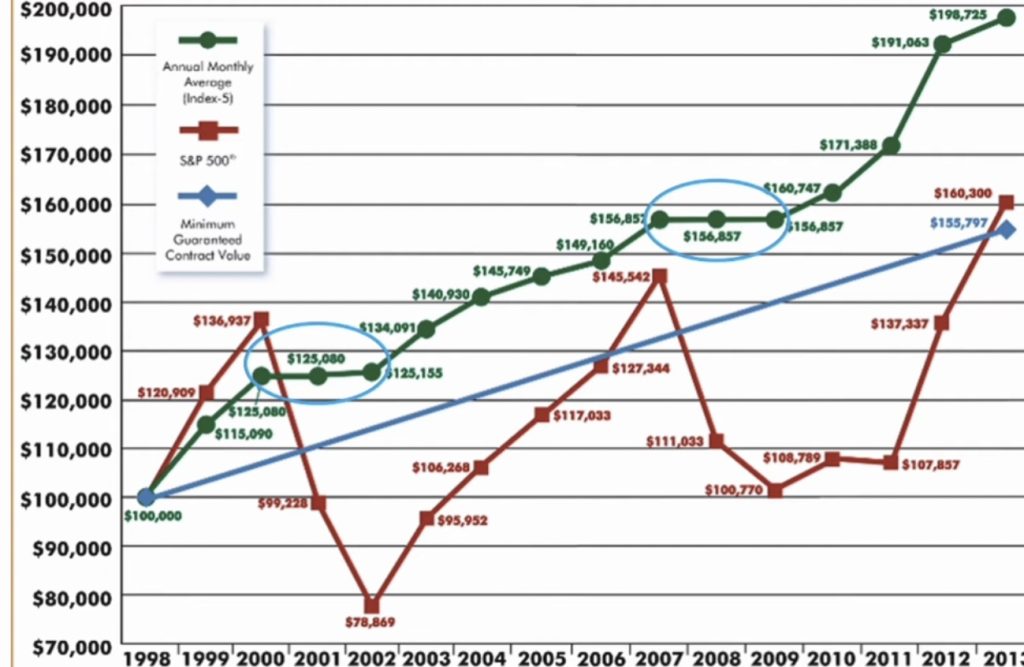

One of the primary drawbacks of 401(k) plans is their susceptibility to market fluctuations. Traditional 401(k)s are often invested in a mix of stocks and bonds, exposing employees to the inherent volatility of financial markets. As seen in recent years, economic downturns can significantly impact the value of retirement accounts, jeopardizing the financial security of those relying on them for their future.

2. Limited Control:

401(k) plans typically offer limited control to employees over their investment choices. Individuals often have a set menu of investment options chosen by the plan administrator. This lack of flexibility can hinder individuals from tailoring their investments to match their risk tolerance, financial goals, and market expectations.

3. Tax Implications:

While 401(k) plans provide tax advantages through pre-tax contributions, withdrawals during retirement are taxed as ordinary income. This can lead to unforeseen tax liabilities for retirees, especially if their tax bracket is higher in retirement than during their working years.

The Appeal of IUL:

Indexed Universal Life (IUL) insurance stands out as an alternative with features that address some of the shortcomings of 401(k) plans:

1. Principal Protection:

IUL policies provide a degree of principal protection by offering a floor on returns, safeguarding the policyholder from market downturns. This ensures a more stable and predictable growth of cash value over time.

2. Flexible Premiums and Withdrawals:

Unlike the fixed contributions and withdrawal restrictions of 401(k) plans, IUL policies offer flexibility. Policyholders can adjust premium payments based on their financial situation, and withdrawals during retirement are often tax-free up to the amount of the premiums paid, providing greater control over one’s financial future.

3. Cash Value Accumulation:

IUL policies accumulate cash value over time, providing a living benefit that can be accessed for various needs, such as supplementing retirement income, funding education, or addressing unforeseen expenses.

Conclusion:

While the decline in 401(k) contributions poses a challenge to employees seeking financial security in retirement, the exploration of alternatives such as Indexed Universal Life (IUL) insurance becomes increasingly relevant. Understanding the downsides of traditional 401(k) plans can empower individuals to make informed decisions about their retirement savings strategy, ensuring a more resilient and tailored approach to securing their financial future.