Financial Security: The Power of Insured Universal Life Insurance Title Here

In today’s fast-paced world, achieving financial security is a goal that resonates deeply with many in the 25-40 age group who are striving to build a life filled with stability, freedom, and the ability to pursue our dreams without constantly worrying about unforeseen financial challenges. Enter Insured Universal Life Insurance (IUL) – a financial tool that holds the potential to unlock a new level of security and peace of mind.

What is Insured Universal Life Insurance?

Let’s break it down without the jargon. Insured Universal Life Insurance, or IUL, is like a supercharged life insurance policy with added financial benefits. It’s not just about leaving a legacy for your loved ones; it’s also about leveraging life insurance to build a strong foundation for your own financial journey.

IUL combines two key features: lifelong coverage and a cash value component. This means that you’re covered throughout your life, no matter what happens. But here’s the kicker – if structured properly almost all of the premium payments is invested, allowing your policy’s cash value to grow over time with compound interest. This cash value can be accessed to supplement your retirement income, fund emergencies, or even achieve other financial goals.

The Flexibility Factor

One of the most attractive aspects of IUL for those in the 25-40 age bracket is its flexibility. We know life doesn’t follow a straight path, and our financial needs change as we grow. IUL adapts to your changing circumstances.

Imagine this: you’re just starting out in your career, maybe with student loans hanging over your head. Your IUL policy can provide a safety net for your loved ones in case anything happens to you. As you progress in your career, your policy’s cash value grows along with the death benefit. This growth can become a cushion to pay off debts, cover unforeseen expenses, or even seize an exciting opportunity without derailing your financial stability.

Tax Advantages and Growth Potential

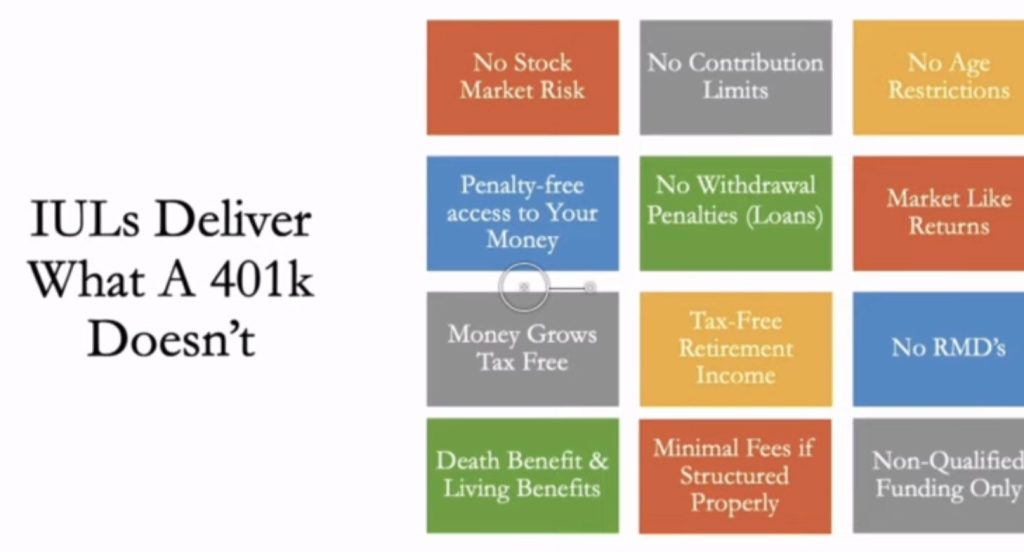

Let’s talk about taxes – not the most thrilling topic, but an important one. IUL policies often come with tax advantages. Due to tax code 7702 of the IRS that lays out the specific requirements for life insurance to meet favorable tax treatment, the growth of your policy’s cash value can be achieved tax-free. This means you don’t pay taxes on the growth unlike a 401k most people pay into. For young professionals looking to make the most of their hard-earned money, this tax advantage can be a game-changer.

Moreover, the investment component of IUL can provide growth potential that traditional savings accounts simply can’t match. Your policy’s performance is tied to a specific index, and if that index does well, your cash value grows. If the index doesn’t do well there is a guaranteed zero floor or zero loss. It’s like planting a financial seed that has the potential to grow into a substantial tree over time.

A Tool for Your Unique Journey

Ultimately, IUL isn’t a one-size-fits-all solution. It’s a dynamic tool that adapts to your unique journey. Whether you’re planning for a family, dreaming of starting your own business, or mapping out your retirement years, IUL has the potential to play a significant role.

It’s important to note that IUL requires careful consideration and understanding. Consulting with licensed professionals who specialize in life insurance is a smart move to ensure you’re making informed choices that align with your goals and structure your policy for maximum gains in retirement.

In Conclusion

For those of us in the 25-40 age group, the idea of financial security isn’t just a distant dream. It’s a tangible goal that we’re actively working towards. Insured Universal Life Insurance can be the key that unlocks this security, offering a blend of protection, growth, and flexibility that resonates with the dynamic lives we lead.

As you navigate the road ahead, remember that IUL isn’t just about life insurance – it’s about life assurance. It’s about building a bridge to your aspirations, securing your loved ones’ future, and empowering yourself to thrive with confidence, knowing that your financial foundation is solid.