Invest With Upside Potential & No Downside Risk-IUL

Subtitle: Seize Upside Gains and Embrace Risk-Free Investment with Guaranteed Zero Floor

Are you in your prime years, seeking a path to financial security that aligns with your aspirations? Imagine an investment strategy that combines the thrill of market growth with the reassurance of zero downside risk. Indexed Universal Life (IUL) might just be the key to unlocking your financial dreams and securing your future. In this article, we delve into how IUL empowers individuals aged 20 to 45 to invest with confidence, harnessing upside gains while enjoying a unique safety net: the guaranteed zero floor.

**1. Understanding the IUL Advantage

Indexed Universal Life is not your typical investment vehicle; it’s a dynamic hybrid that merges life insurance coverage with investment opportunities. This ingenious combination enables you to enjoy the best of both worlds: life protection for your loved ones and a potential avenue for building wealth.

**2. Embrace Upside Gains: Riding the Market’s Momentum

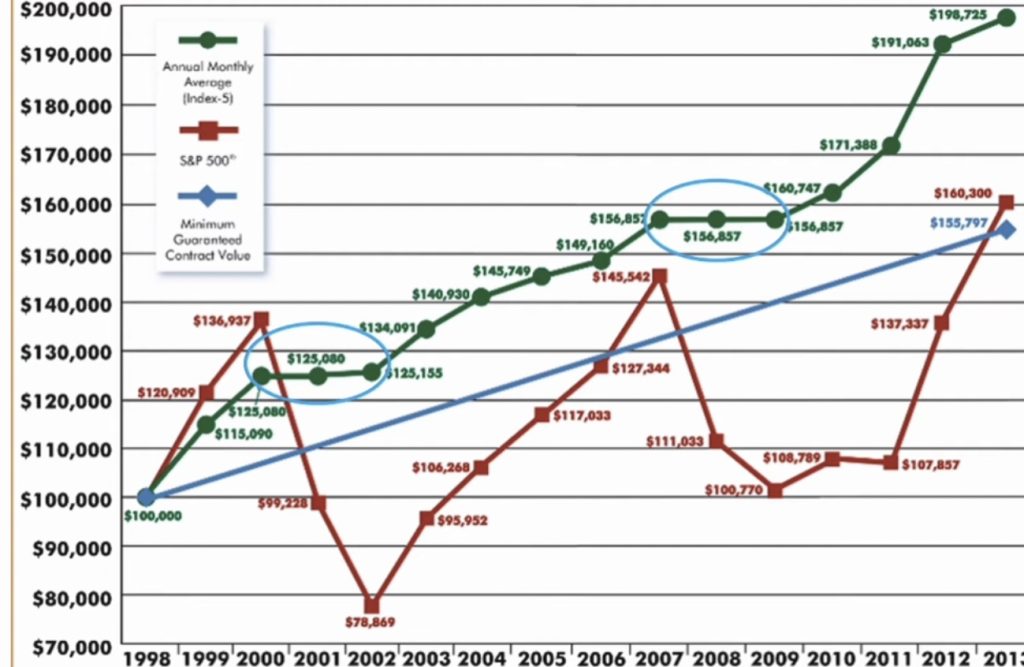

Picture this: you’re invested in the stock market, and the economy takes a leap. With IUL, you have the chance to ride the wave of market growth. How? Your money is linked to a market index, such as the S&P 500. As the index climbs, so does your policy’s cash value. This means your wealth potential is directly tied to market performance – when markets soar, so can your financial wellbeing.

**3. Zero Downside Risk: The Game-Changing Guaranteed Zero Floor

Let’s address the elephant in the room – risk. Traditional investments can be nerve-wracking, as market downturns can erode your hard-earned money. Here’s where the magic of IUL comes into play: the guaranteed zero floor. Regardless of how the market performs, your policy’s cash value won’t drop below this floor. This ensures that even during downturns, your investment remains safe and sound, allowing you to sleep peacefully while still participating in market upsides.

**4. Tailored Control: Your Financial Future, Your Way

In your age group, flexibility is crucial. IUL offers just that. You have the power to adjust your premiums and coverage, allowing your policy to evolve with your changing circumstances. As your career advances, or your family expands, your IUL can adapt to meet your needs.

**5. Tax Advantages: Gains on Your Terms

Tax efficiency is another feather in IUL’s cap. Unlike traditional investments that might be subject to capital gains taxes, the gains within an IUL policy grow tax-free. This means your wealth accumulates faster since you’re not losing a portion of it to taxes every year.

**6. Long-Term Vision: Building Generational Wealth

IUL isn’t just about your financial wellbeing; it’s about creating a lasting legacy for your family. The cash value growth potential can be tapped into later in life, providing a source of supplemental income during retirement or passing on a substantial sum to your heirs.

**7. Taking the Leap: Your Journey to Financial Prosperity

Embarking on your IUL journey requires careful consideration and guidance. Work with professional licensed agents who specialize in IUL to create a customized plan that aligns with your goals, risk tolerance, and life stage.

In conclusion, Indexed Universal Life presents a remarkable opportunity for the 20 to 45 age group to invest confidently. By embracing upside gains while enjoying the security of a guaranteed zero floor, you’re not just investing in your financial future – you’re investing in your peace of mind. Take the leap into this innovative world of financial growth and security, and pave the way for a brighter, more prosperous future. Your dreams deserve nothing less.