Is Our Pension Fund (Social Security) Similar to a Ponzi Scheme?

Let’s go back in time to Charles Ponzi when in 1920 he was at the height of his powers, living the sort of lavish lifestyle you might have seen Leonardo DiCaprio portray in the great Gatsby.

The scheme involved him using a type of voucher that was used to pay for international mail. Ponzi found he could buy these vouchers cheaply in Italy and swap them for more expensive US stamps, making a big profit. For a short time everything looked rosy both for Ponzi and his investors.

But for Ponzi the scam began to unravel when financial analyst, Clarence Baron observed that Ponzi’s claim of profits would require 160 million reply coupons in circulation to cover his liabilities while only about 27,000 actually existed.

The media, started digging deeper, exposing inconsistencies and suspicions.

Amid mounting legal pressures investors panicked and started demanding their money back. The scheme could not withstand the rush of withdrawals leading into its collapse. Ponzi was arrested in August 19, 2020 & imprisoned prison for several years.

He ended up spending his final years in poverty and poor health.

By now you may have noticed the striking similarities between the two schemes of pensions/social security and the Ponzi scheme.

Of course a fundamental difference between the two is that Ponzi’s have criminal intent, while pension schemes are well intended with the purpose taking care of the elderly & retired.

But in other respects they’re not that different.

Here are the similarities:

1. **Structural Parallels:** Just like Ponzi schemes, traditional pension systems are structured in a way that relies on incoming contributions from new participants to pay the benefits of older participants. This structure shares similarities with the “robbing Peter to pay Paul” nature of Ponzi schemes.

2. **Sustainability Challenges:** Ponzi schemes are known for their inherent unsustainability, as they require a constantly increasing number of participants to maintain payouts. Similarly, pension schemes in developed countries are facing sustainability challenges due to factors like declining birth rates and an aging population. The diminishing worker-to-retiree ratio is a core issue affecting the financial viability of these schemes.

3. **Unreliable Promises:** Charles Ponzi promised significant returns on investments, which proved to be unreliable. While not universally the case, in some jurisdictions, pension schemes also make promises that may not be fulfilled. An example in California* highlights how overestimated calculations have led to taxpayers having to fund state employee pensions, similar to how Ponzi schemes eventually collapse due to unsustainable promises.

4. **Future Uncertainty:** The question of whether there will be enough money left in pension funds when individuals retire or if pensions will collapse like a Ponzi scheme raises concerns about the future financial security of retirees.

These points highlight the similarities between pension schemes and Ponzi schemes, particularly in terms of structural issues and sustainability challenges.

So will there be any money left in the Social Security Pension Fund when you retire?

Or will the fund turn out to be like a Ponzi scheme?

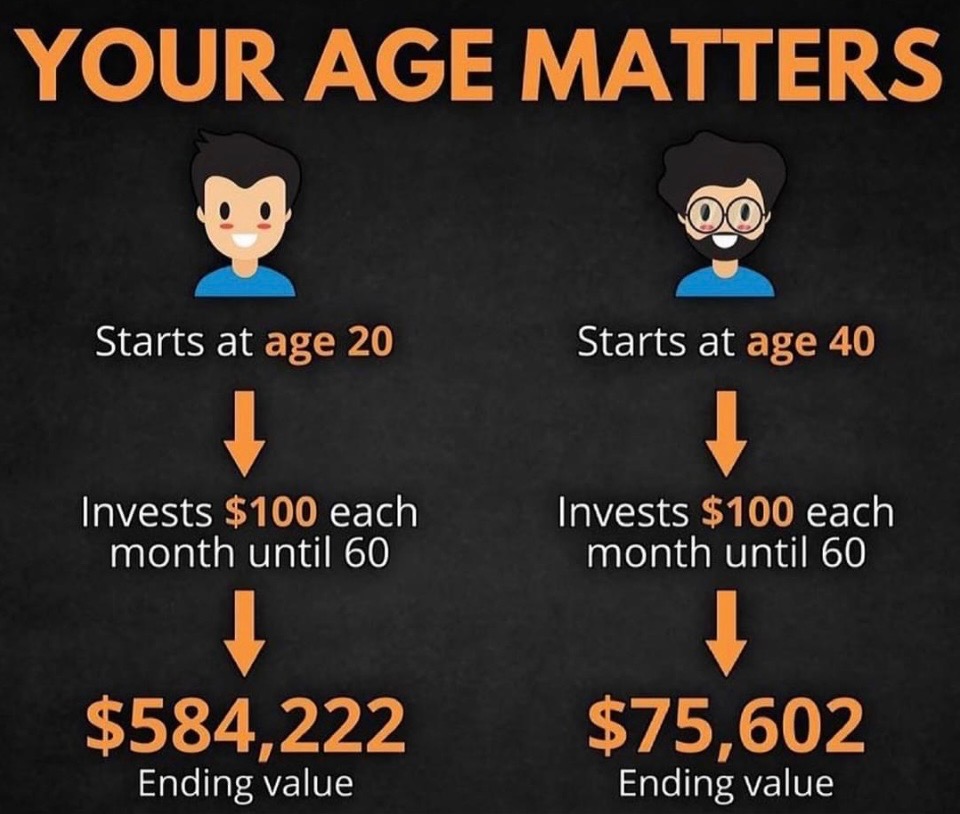

Nows the time for you to answer that question for you to answer because the longer you wait the more you lose!

If you’re interested in a tax-free retirement paid for life, with protection financially in case of chronic, critical, or terminal illness or injury, then contact us so you can understand how an indexed universal life insurance policy or IUL can meet the above needs for your retirement.

It’s the option Gen X, Millennials & Gen Z can use instead of counting on a scheme that’s not sustainable and insufficient to live on.