Navigating Inherited Wealth: Unraveling the Complexity of 401(k) vs. IUL Beneficiary Benefits

Inheriting a 401(k) can be complex due to tax implications and required minimum distributions (RMDs). Beneficiaries may face penalties if they don’t adhere to specific withdrawal schedules, impacting their financial planning.

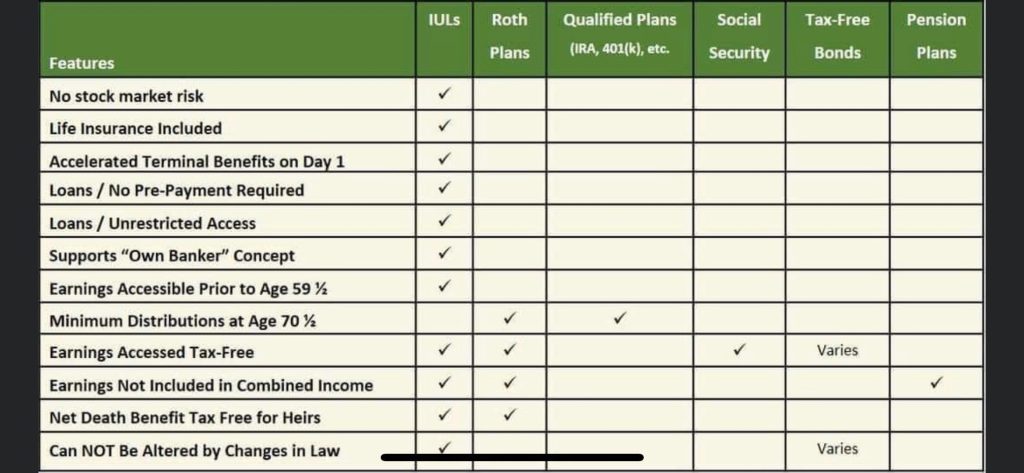

Conversely, inheriting an Indexed Universal Life (IUL) policy tends to be more straightforward. The death benefit is generally tax-free, and beneficiaries have flexibility in accessing the cash value without immediate tax consequences.

The 401(k) complexity arises from the need to navigate IRS regulations, potential taxes on distributions, and the impact on long-term growth. On the other hand, an IUL often offers a smoother process with fewer tax complications, making it a more user-friendly option for beneficiaries.

At PRB Financial Services, our vision is to empower individuals and families to safeguard their financial futures and protect their loved ones from unforeseen life events.

Peter Behn

Licensed Insurance Agent: 0195319