Navigating the Balance: Supporting Adult Children Without Jeopardizing Your Retirement

In a world that celebrates financial independence, a concerning trend is on the rise—parents risking their retirements to support their adult children. While the instinct to help is natural, the long-term consequences can be damaging. This article explores why this trend is growing, its impact on parents’ retirements, and the importance of striking a balance between supporting loved ones and securing your financial future.

The Trend on the Rise:

More and more parents are finding themselves juggling the challenge of providing financial support to their adult children. Whether it’s aiding with education costs, assisting in home purchases, or helping with unexpected financial crises, parents are extending their support well into retirement. This shift raises questions about the sustainability of this dynamic and its impact on both generations.

What’s Driving Financial Support:

Several factors contribute to parents taking on financial burdens for their adult children:

Rising Educational Costs: Soaring education expenses lead parents to dip into their retirements to fund their children’s higher education, often resulting in delayed retirements.

Housing Challenges: Skyrocketing real estate prices and tough economic conditions prompt parents to assist their children in securing housing, further straining their finances.

Job Market Uncertainties: The unpredictable job market and the rise of gig economy jobs may lead parents to provide ongoing financial support as their adult children navigate career challenges.

Consequences for Parents’ Retirements:

Jeopardizing retirements for adult children has significant consequences:

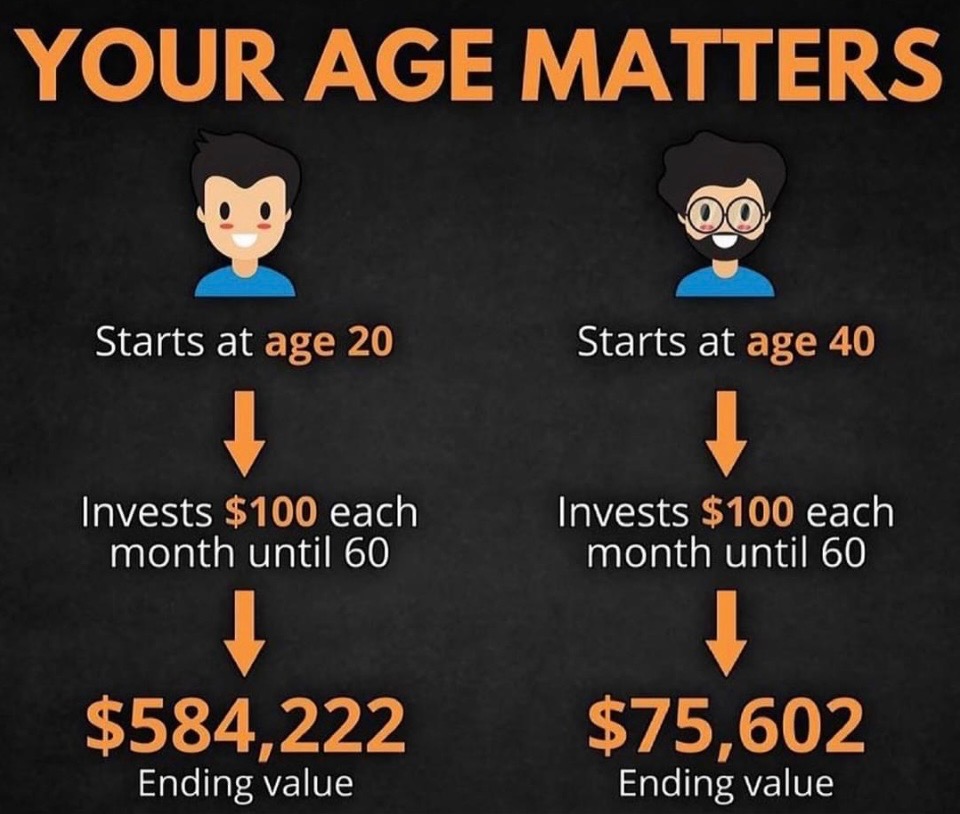

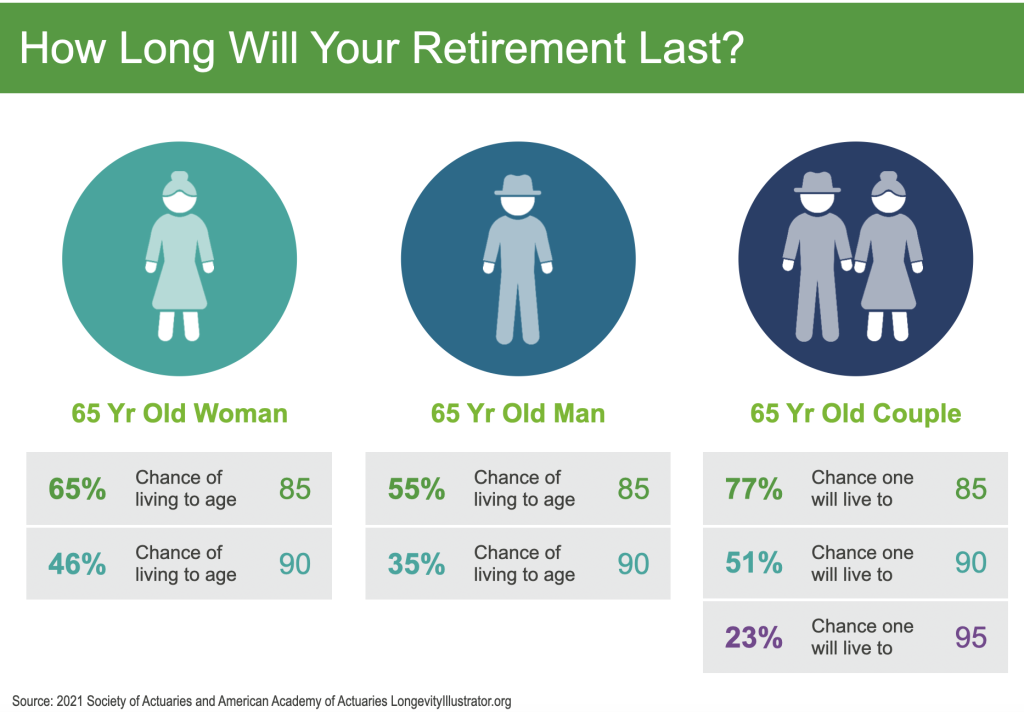

Financial Instability: Parents risk depleting their retirement savings, leaving them financially vulnerable in their golden years.

Delayed Retirement: Rebuilding savings may force parents to delay retirement, impacting their quality of life later on.

Strained Family Dynamics: Financial dependencies can strain family relationships, causing stress among family members.

Balancing Act:

While supporting adult children is commendable, finding a balance is crucial. Here are steps parents can consider:

Open Communication: Talk openly about financial expectations, responsibilities, and long-term goals.

Set Boundaries: Clearly define limits of financial support to avoid overextending resources.

Encourage Financial Independence: Support adult children in developing financial literacy and independence.

Conclusion:

Parents risking their retirements for adult children reflects changing family and financial dynamics. Balancing support and securing your financial future is vital. As society evolves, fostering financial independence among adult children becomes crucial for the well-being of both generations. It’s time for open conversations and proactive measures to ensure sacrifices made out of love don’t compromise retirements. Remember, this information is for reference only and consult a professional for personalized advice.