Securing Your Financial Future: The Strength of Life Insurance

In the fast-paced and ever-changing world we live in, financial security is of utmost importance, especially for young adults in the age group of 20 to 45. Recent times have been marked by uncertainty and economic turbulence, from the global pandemic to market downturns, making it crucial to explore stable and reliable investment options. In light of events like the Silicon Valley Bank’s failure, many investors seek safe havens for their money, and the life insurance industry stands out as a resilient choice during times of crisis.

The Closure of Silicon Valley Bank: A Wake-Up Call

The sudden closure of Silicon Valley Bank sent shockwaves through the financial system. The bank’s high exposure to interest rate increases in the bond market weakened its financial position. When tech sector borrowers began withdrawing their deposits, it triggered a bank run that eventually led to its closure. While the bank’s customers were eventually compensated, this event highlighted the risks associated with investing in traditional financial institutions like banks.

Life Insurance Industry: Stability in Uncertain Times

On the other hand, the life insurance industry has proven to be steady and strong, even in the face of crises. Over the years, we have witnessed the myriad ways life insurance touches the lives of consumers. Unlike some banks that may face liquidity and solvency concerns, life insurance companies are structured more conservatively and have lower exposure to specific factors, such as interest rates. They maintain higher reserve levels, making it less likely for investors to swiftly withdraw all funds from a life insurance policy.

Addressing Liquidity and Solvency Concerns

It’s important to differentiate the liquidity and solvency of life insurance companies from traditional banks. Life insurance companies demonstrate a marked difference in their liquidity and are better equipped to handle financial challenges compared to banks. Though there is a theoretical possibility of a run on the cash value of policies, the likelihood of this happening is extremely remote. Those with retirement savings tied to insurance policies need not fret, as the chances of a mass withdrawal are negligible. While some insurance companies may have minimal interest rate and bond exposure, regulatory requirements limit their vulnerability to such risks.

A History of Resilience

If you’re seeking a safe place to invest your hard-earned money, the life insurance industry presents a compelling option. With some companies boasting over a century of existence, they have weathered significant financial crises, from the Great Depression and World War Two to the inflation crisis of the 1970s, Black Monday in 1987, the Great Recession, and the Covid-19 pandemic. Many of these companies have consistently paid dividends to their policyholders for decades, attesting to their financial stability and reliability.

Growing Interest in Insurance Policies

During times of economic turmoil, investors often seek more conservative options, leading to increased interest in the insurance industry. As a result, purchasing life insurance policies in the secondary market has gained traction. Wall Street institutions and wealthy accredited investors have shown a strong belief in the industry’s safety, and managed portfolios in the life insurance sector are becoming increasingly common.

Securing Your Financial Future

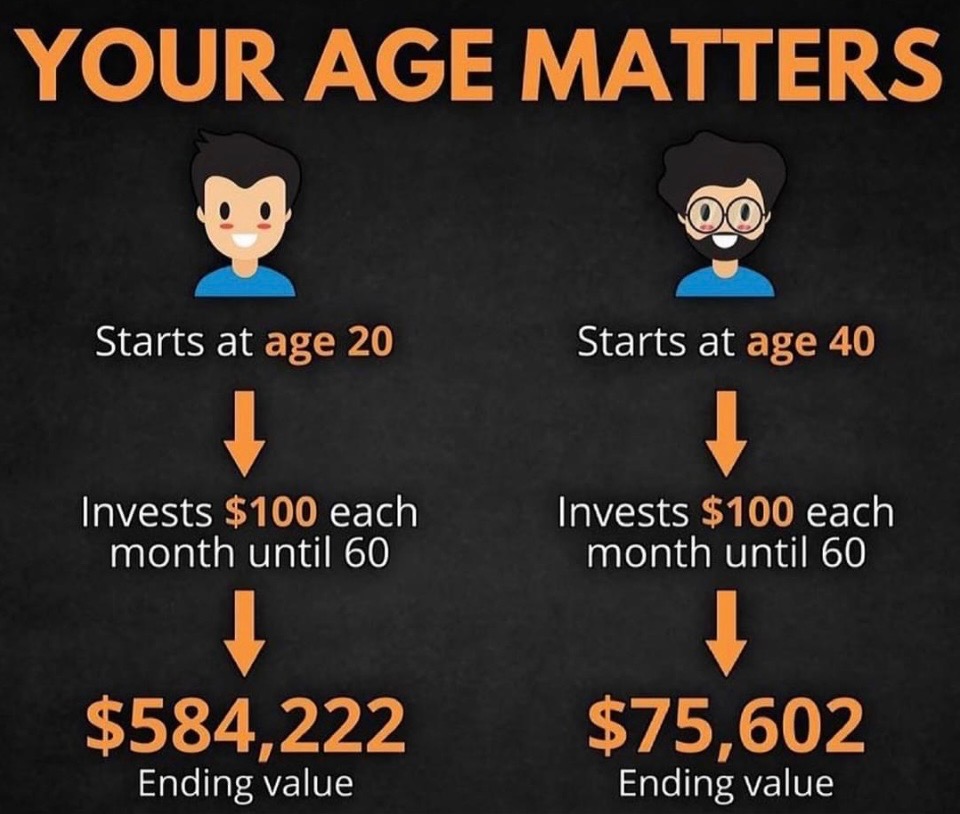

For young adults in the age group of 20 to 45, building a secure financial future is paramount. While traditional investments may carry risks and uncertainties, the life insurance industry remains a resilient and stable option. With its conservative structure, high reserves, and proven track record of weathering crises, it stands out as a viable choice for investors seeking security and growth potential. Consider exploring the opportunities offered by the insurance industry to safeguard your financial well-being in these uncertain times.