The Pros & Cons of 401ks and ROTH IRAs plus a Third Option

When it comes to planning for retirement, understanding the various options available is crucial. Two popular choices are the 401(k) and Roth IRA. Let’s explore the pros and cons of each before introducing a third option, Indexed Universal Life Insurance (IUL), which brings unique advantages to the table.

401(k) vs. Roth IRA:

401(k):

A 401(k) is a retirement plan offered by your employer, allowing you to allocate a portion of your paycheck into the account. Here are its pros and cons:

Pros:

1.Tax Write-Off: Contributions to a 401(k) reduce your taxable income, resulting in immediate tax benefits.

2.Employer Matching: Many companies offer a match on your contributions, providing additional free money for your retirement.

3.Bigger Contribution Limits: 401(k) allows higher annual contributions compared to a Roth IRA.($22,500 in 2023)

Cons:

1.Taxes on Withdrawals: Any money withdrawn from the 401(k) during retirement is subject to taxation.

2.High Fees: Some 401(k) plans charge high fees, affecting your overall returns.

3.Limited Investment Options: 401(k) often offers a limited selection of investment choices, potentially limiting your diversification.

If your looking for a particular investment it may not be an option with your plan.

4.Early Withdrawal Penalties: Taking out funds before retirement age (59 1/2)can result in a 10% penalty.

5.Required Minimum Distributions (RMDs): At age 72, you’re required to withdraw a minimum amount annually.

Roth IRA:

A Roth IRA is a retirement plan you set up independently, not through an employer. Let’s explore its advantages and disadvantages:

Pros:

1.Tax-Free Withdrawals: Contributions and earnings in a Roth IRA grow tax-free, providing tax-free income during retirement.

2.More Investment Options: Roth IRAs often offer more investment flexibility compared to 401(k) plans.

3.Minimal Fees: Roth IRAs are known for having lower fees, maximizing your potential returns.

4.No Required Minimum Distributions: Unlike a 401(k), you won’t be forced to take withdrawals at a certain age.

5.No Early Withdrawal Penalties for Contributions: You can withdraw your direct contributions without penalties.

Cons:

1.No Upfront Tax Deduction: Contributions to a Roth IRA are not tax-deductible, unlike a traditional 401(k).

2.Lower Contribution Limits: Roth IRA has lower annual contribution limits compared to a 401(k).($6500 in 2023)

3.Income Limitations: High earners may not be eligible to contribute to a Roth IRA.

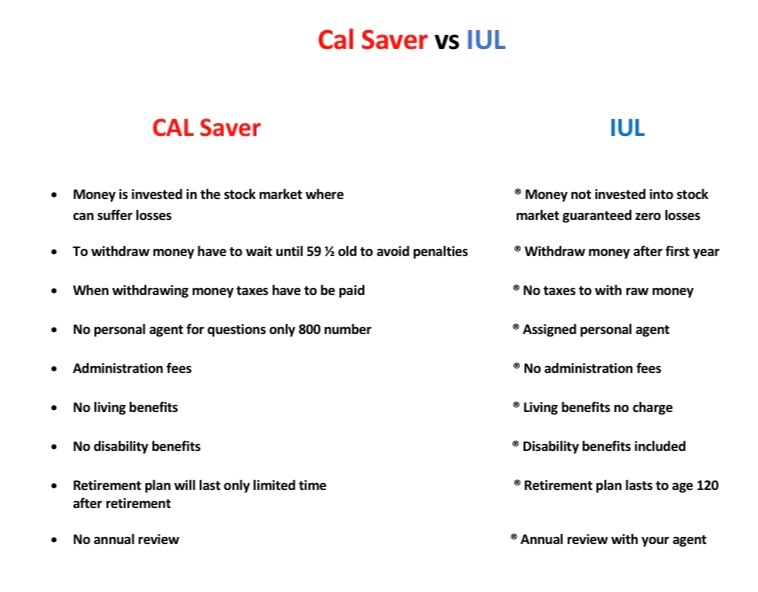

Introducing Indexed Universal Life Insurance (IUL):

Now, let’s consider an alternative retirement planning option: Indexed Universal Life Insurance (IUL). IUL offers unique advantages that may suit certain individuals seeking a comprehensive retirement strategy:

Advantages of IUL:

1.Tax-Free Growth: Similar to the Roth IRA, IUL allows your cash value to grow tax-free, providing you with tax-efficient income during retirement.

2.Lifetime Coverage: Unlike the 401(k) and Roth IRA, IUL includes a death benefit that offers financial protection for your loved ones, ensuring your legacy.

3.Market Participation with Protection: IUL’s cash value is linked to the performance of stock market indexes, providing growth opportunities with downside protection, a zero floor.

4.Flexibility in Contributions: IUL allows you to adjust premium payments based on your financial situation, granting you control over your policy.

5.No Income Limitations: Unlike the Roth IRA, IUL does not have income limitations, making it accessible to higher-income individuals.

6.Access to Cash Value: IUL enables you to access your cash value through policy loans or withdrawals, offering a potential source of funds during emergencies as well as tax-free retirement income.

7. In the IUL from National Life Group included in the IUL are Living Benefits for Terminal, Critical, Chronic illnesses as well as disability coverage.

While IUL presents its advantages, it may not be the best fit for everyone depending on your health or age.

To make an informed choice, consult with a licensed agent who can help tailor a retirement strategy using an IUL that aligns with your specific needs and aspirations. Remember, a well-thought-out retirement plan is essential for a secure and comfortable future.