The "Un-retirement Crisis" - Gen X Next in Line

For those who’ve devoted their entire lives to build a nest egg for their golden years, it’s disheartening to realize that they might not have enough to enjoy a peaceful retirement. The haunting specter of the “Unretirement Crisis” has engulfed America, leaving people toiling well into their late 60s or later, only to face the possibility of working indefinitely.

The situation is even more alarming than what the doomsayers foretell. We’re now deeply entrenched in the dreaded “Not Enough Era,” and the numbers are staggering. Boston College revealed a shocking $7.1 trillion retirement-savings shortfall among American households, reminiscent of the conditions faced during the Great Depression, where people worked until their last breath or relied on charity when they couldn’t work anymore.

Sadly, the “Gen X” generation, born between 1965 and 1980, is at the forefront of this crisis. A generation that grooved to “Wooly Bully” and celebrated Blondie’s “Call Me” as chart-topping hits. With both parents working full-time, Gen X became more educated than their predecessors. Yet, as they draw closer to retirement, they find themselves facing the harsh reality of not having saved enough.

According to data from investment bank Natixis, the average median retirement savings for Gen Xers is a meager $81,000 – a far cry from the projected $1.2 million required for comfortable living during retirement, and that estimate might even be too conservative. Last year’s staggering loss of $6.8 trillion in stock-and-housing wealth, coupled with inflation and uncertainty, has only worsened this crisis. There’s no cavalry coming to the rescue; this storm will only intensify.

Now, here’s the silver lining: it’s not too late to get back on track. The key lies in investing for income, but not in traditional options like CDs, bonds, or money markets, which offer yawn-inducing yields. We’re talking about embracing “new school” approaches that adapt to the current uncertain times and ensure a steady stream of income.

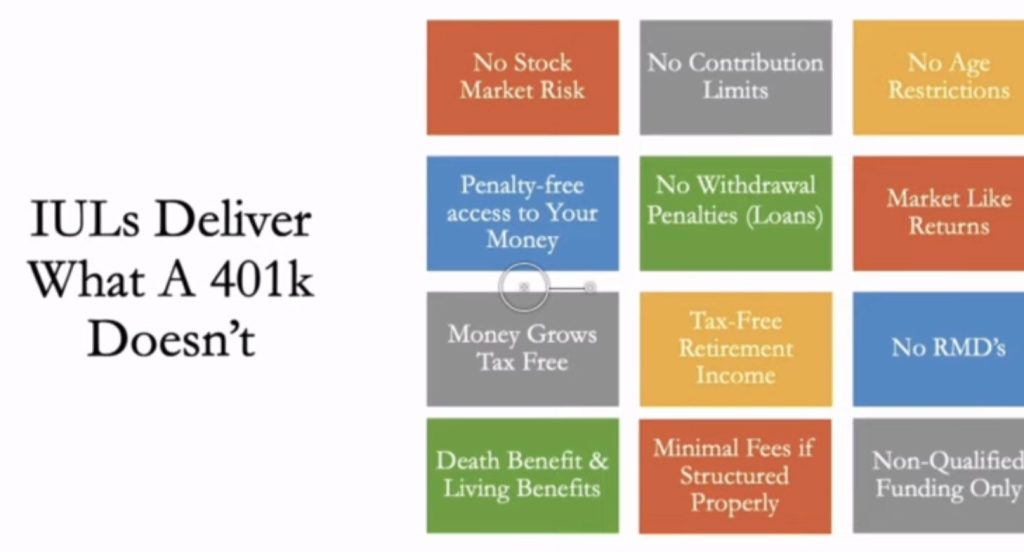

One such powerful solution is the Indexed Universal Life insurance (IUL). Imagine it as the ultimate financial power-up for your retirement game. The IUL empowers you to harness the potential of the stock market without the risk of losing it all. It’s like finding the secret level in your favorite video game – you get the rewards of market growth without the heart-pounding fears of market downturns.

With tax advantages and the potential for a lifetime income stream, the IUL emerges as the hero in the quest to secure your financial future. It’s time to embrace this “new school” approach and navigate the uncertainty of our times with confidence. So, fellow Gen Xers, let’s take control of our financial destinies and level up our retirement game with the powerful IUL by our si