Unlock Financial Peace of Mind: Long-Term Care Insights and IUL Living Benefits Explained

Planning for the future is a journey that spans all ages, and understanding the dynamic duo of long-term care insurance and Indexed Universal Life (IUL) can be your key to financial security.

**Navigating Long-Term Care Insurance: A Wise Move at 60**

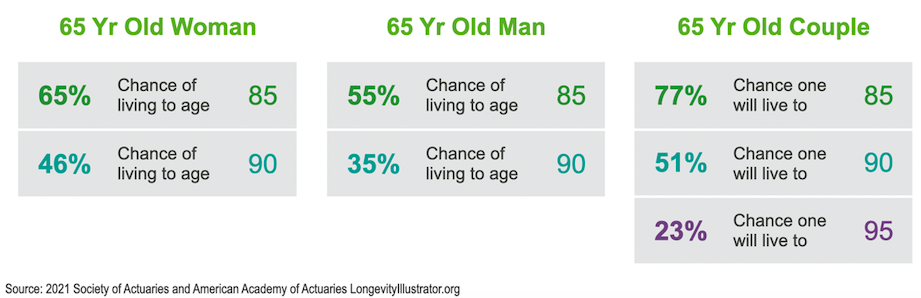

Embracing long-term care insurance at the age of 60 is a strategic decision that not only promises lower premiums but also shields you from unnecessary costs in your 50s when long-term care needs are less likely. Without this coverage, the burden of out-of-pocket expenses for in-home, assisted living, or nursing home care can be overwhelming, with costs reaching $234,000 in the last five years of life—or $367,000 for those dealing with dementia.

Factors such as age, health, gender, and location play a role in determining premiums, which can range from $1,000 to $10,000 annually. Tailoring your policy to your needs—choosing the right term, benefit, and inflation protection—ensures a customized and cost-effective approach to long-term care planning.

You’ll pick a term (a time of 1–10 years) and benefit (the amount your insurer will pay). When you need in-home, assisted living or nursing home care, your insurer will pay your monthly benefit to help cover those costs for the length of your term.

**The IUL Advantage: Living Benefits for All Ages**

Enter the Indexed Universal Life (IUL) insurance policy with living benefits—an innovative solution that transcends age boundaries. This dynamic policy not only secures your loved ones in the event of your passing but also provides a unique living benefit for chronic care coverage.

Imagine having access to 1% of your policy’s face value to address long-term care expenses when facing chronic illness. This game-changing feature ensures financial flexibility, allowing you to navigate the complexities of in-home care, assisted living, or nursing home expenses without compromising your financial well-being.

In contrast with long term care policies ranging from 1-10 years the IUL can provide coverage up to age 120.

Unlike traditional long-term care insurance, an IUL serves as a versatile financial tool, contributing to both immediate and long-term financial goals. It’s not just insurance; it’s a comprehensive strategy for financial peace of mind.

**Holistic Security for Every Stage of Life**

Combining the strengths of long-term care insurance and IUL living benefits creates a holistic approach to financial security. Whether you’re planning for retirement, safeguarding against unexpected health challenges, or ensuring a legacy for your loved ones, this strategic blend provides a roadmap for all ages.

So, embark on your journey to financial peace of mind—understand the nuances of long-term care insurance and harness the power of IUL living benefits. It’s not just a plan; it’s your key to a secure and fulfilling future.”