What is a B.O.L.I and Why it's Important to Know

Bank Owned Life Insurance (BOLI) is a smart way for banks to save money on employee benefits. Here’s how it works in simple terms:

Imagine a bank buying an insurance policy on the life of one of its top executives. If that executive passes away, the bank gets a tax-free payment from the insurance company. But BOLI is more than just insurance. It’s a way for banks to manage their money wisely and help pay for employee benefits.

There are three types of BOLI plans that banks can choose from:

General Account: This is the most common type. The bank invests money in an insurance company’s general account. The insurance company uses this money to invest in things like real estate and bonds. The bank earns a certain amount of interest on this investment, and it’s like a source of income.

Separate Account: Here, the insurance company puts the bank’s money into specific investments chosen by experts. These investments are carefully managed, and the bank can see exactly where its money is going. The interest the bank earns is based on how well these investments do.

Hybrid Account: This is a mix of the two previous types. It gives the bank the benefits of both general and separate accounts. The bank can earn interest like in a general account, but it also gets transparency and control like in a separate account.

Now, let’s see how BOLI benefits banks:

Cost Savings: BOLI helps banks save money on employee benefits. It’s like an investment that grows over time, helping the bank cover the costs of benefits like retirement plans.

Wise Investment: BOLI’s growth is better than what the bank would get from other types of investments. So, it’s a smart choice for banks to put their money in BOLI.

Tax Advantages: The money that grows in a BOLI plan isn’t taxed until it’s taken out. This means the bank can make more money in the long run.

Compliance: The money earned from BOLI can be used to pay for employee benefits, which keeps the bank in line with the rules.

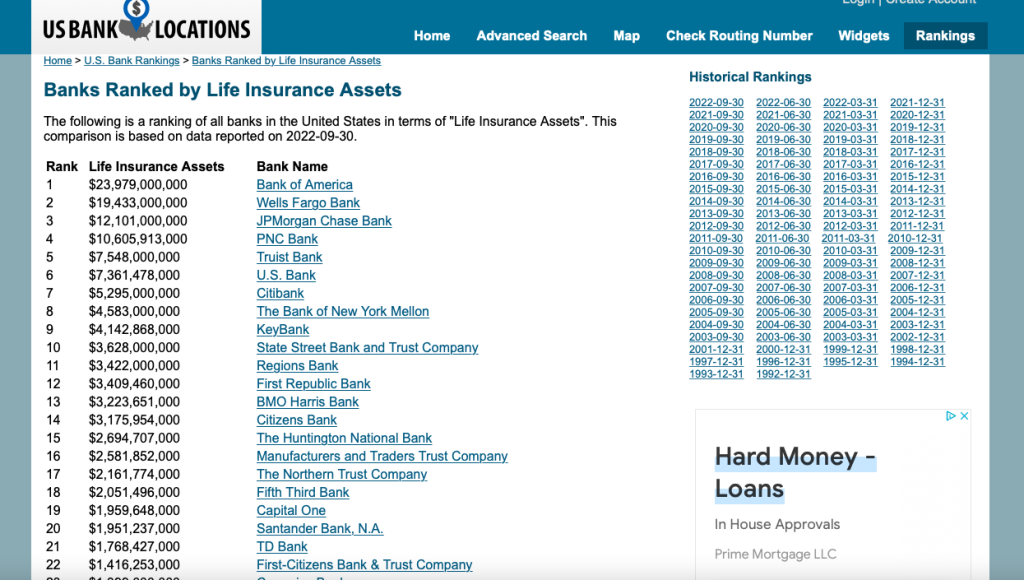

Good for the Balance Sheet: BOLI is treated as an “other asset” on the bank’s financial statements. The earnings from BOLI are recorded as “other income,” making the bank’s balance sheet stronger.

So, in simple terms, BOLI is a way for banks to make smart investments, save on employee benefits, and grow their money without heavy taxes. It’s a long-term plan that helps banks manage their finances well.