Unveiling the Wealthy's 401(k) Secrets

Title: Unveiling the Wealthy’s 401(k) Secrets: Is Indexed Universal Life (IUL) a Better Option?

When it comes to building wealth and securing their financial futures, the affluent often appear to possess a secret formula. One piece of this financial puzzle involves their knowledge of retirement planning, particularly their approach to 401(k) accounts. While 401(k)s are a popular retirement savings tool, the wealthy may know something that the average person doesn’t: the potential benefits of Indexed Universal Life (IUL) insurance as an alternative or complementary retirement savings strategy. In this article, we’ll delve into what the rich know about 401(k)s and explore why they might consider IUL as a superior option.

Understanding the 401(k)

A 401(k) is a retirement savings account sponsored by an employer, where employees can contribute a portion of their pre-tax income. It offers various investment options, such as stocks, bonds, and mutual funds, allowing the account holder to grow their savings over time. One of the main benefits of a 401(k) is the potential for employer matching contributions, which can significantly boost your retirement nest egg.

However, there are limitations and drawbacks associated with 401(k)s:

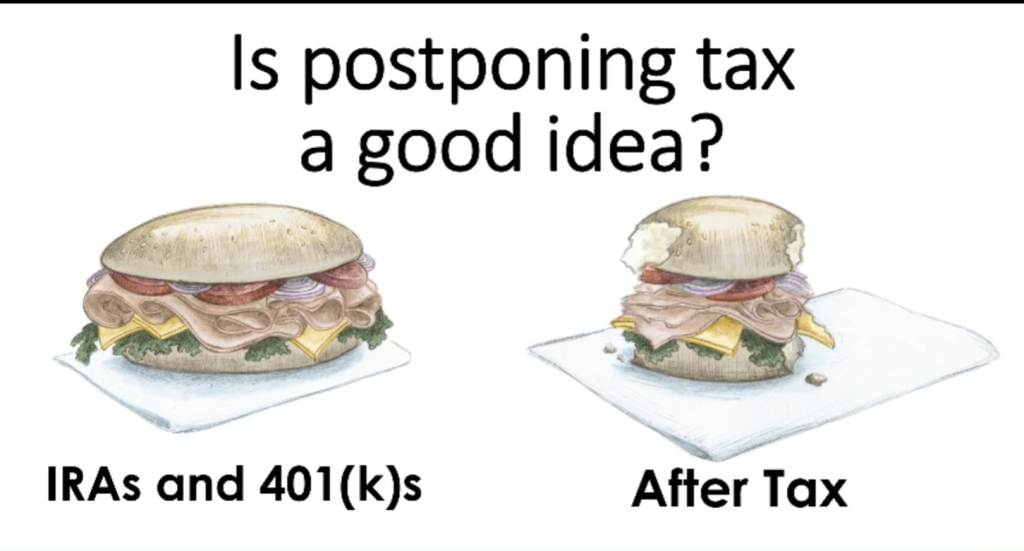

Tax Deferral: Contributions to a traditional 401(k) are tax-deferred, meaning you’ll pay income tax when you withdraw the funds in retirement. For the wealthy, this could result in substantial tax liabilities if they’ve accumulated significant savings.

Contribution Limits: The IRS imposes annual contribution limits on 401(k) accounts, which can hinder the ability to maximize retirement savings, especially for high earners.

Market Volatility: 401(k)s are exposed to market fluctuations, which can lead to substantial losses during economic downturns. Wealthy individuals may be more risk-averse when it comes to preserving their assets.

RMDs: After reaching a certain age (currently 72), individuals with 401(k)s are required to take required minimum distributions (RMDs), which can impact their tax liabilities and reduce the potential for wealth transfer.

The IUL Advantage

Indexed Universal Life insurance (IUL) is a type of permanent life insurance that offers a unique blend of life insurance protection and cash value accumulation. Here’s what the wealthy know about IUL and why they might view it as an attractive alternative to or supplement for their retirement planning:

Tax Benefits: IUL offers tax-free growth, meaning your cash value accumulates without being subject to income tax. When structured properly, policyholders can access this cash value in retirement without incurring tax liabilities.

Market Protection: IUL policies are tied to stock market indices, but they come with a floor, which means your cash value won’t decline due to market downturns. For wealthy individuals concerned about preserving their wealth, this can be particularly appealing.

No Contribution Limits: Unlike 401(k)s, IUL policies have no annual contribution limits, allowing high earners to allocate significant funds towards their retirement savings without restrictions.

Flexibility: IUL provides flexibility in premium payments, allowing policyholders to adjust their contributions according to their financial situation. This can be especially beneficial for the wealthy, whose income may vary from year to year.

Wealth Transfer: IUL policies can serve as an effective wealth transfer tool, allowing policyholders to leave a tax-free death benefit to their heirs, helping to preserve their legacy.

Conclusion

While 401(k)s are a valuable retirement savings tool for many Americans, the wealthy often have additional strategies at their disposal, such as Indexed Universal Life insurance. The knowledge gap regarding IUL may stem from its complexity and the fact that it’s not the right fit for everyone. Nevertheless, for high earners concerned about taxes, market volatility, and the preservation of their wealth, IUL can be a compelling option. It’s essential to consult with a financial advisor or planner to determine whether IUL aligns with your financial goals and to explore the best retirement strategy for your unique circumstances.