Why So Many FundMe's These Days? How an IUL Solves Most of the Problems

In today’s interconnected world, crowdfunding has become an increasingly popular means for individuals, organizations, and causes to raise money. One of the most prevalent platforms for crowdfunding is GoFundMe, which enables people to create campaigns and seek financial support for various reasons. While crowdfunding campaigns can be launched for a wide range of purposes, certain common problems often serve as triggers for individuals to establish a GoFundMe account. In this article, we will explore the most prevalent issues that lead people to create fundraising accounts and how an Indexed Universal Life (IUL) insurance policy can provide a strategic financial solution to address these challenges.

Medical Expenses:

One of the most common reasons individuals establish GoFundMe campaigns is to cover medical expenses. Healthcare costs in many countries can be exorbitant, leaving people burdened with bills they cannot afford to pay. Major surgeries, ongoing treatments, and emergencies can quickly deplete savings and push individuals or families into financial distress. In such dire circumstances, crowdfunding offers a lifeline to help offset medical bills and ease the financial burden.

How an Indexed Universal Life (IUL) Can Help:

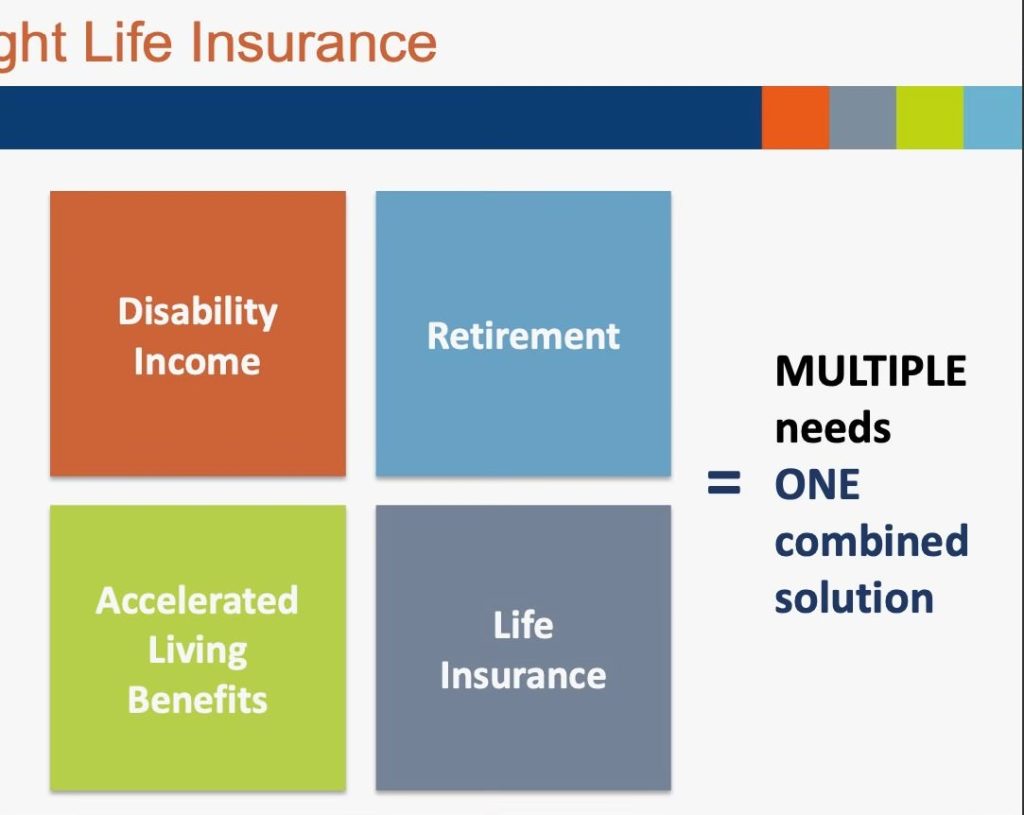

An IUL goes beyond traditional life insurance by offering living benefits that can provide significant financial assistance in times of medical need:

Living Benefits: Built into the IUL policy are living benefits that can be a financial lifeline during challenging health situations. These living benefits can be categorized into three main areas:

Chronic Illness Coverage: If you are diagnosed with a chronic illness, an IUL policy can provide a portion of the death benefit in advance to help cover medical expenses and maintain your quality of life.

Critical Illness Coverage: In the event of a critical illness diagnosis, such as cancer or a heart attack, an IUL policy can offer accelerated benefits, ensuring that you have the necessary funds to pursue treatments, surgeries, and rehabilitation without financial strain.

Terminal Illness Coverage: If you receive a terminal illness diagnosis, an IUL policy can provide access to the death benefit while you are still alive. This enables you to address end-of-life expenses, make arrangements, and secure the financial well-being of your loved ones.

Disability Coverage: An IUL can also include disability coverage, which provides financial support if you become disabled and are unable to work. This coverage can help maintain your lifestyle and cover ongoing medical and living expenses during a period of disability.

Senior Care Substitute: For seniors facing the high costs of long-term care or assisted living facilities, the cash value within an IUL policy can be used to cover these expenses. This can be a valuable alternative to traditional long-term care insurance, offering more flexibility and control over your finances.

Funeral and Memorial Costs:

Funerals and memorial services can be unexpectedly costly, and grieving families may struggle to come up with the necessary funds in a timely manner. Setting up a GoFundMe account to cover funeral expenses has become a common practice to ensure a dignified farewell for loved ones. Friends and family, as well as sympathetic strangers, often contribute to help alleviate the financial stress during this emotional time.

How an Indexed Universal Life (IUL) Addresses Funeral and Memorial Expenses:

An IUL policy provides a unique financial advantage when it comes to addressing funeral and memorial costs:

Death Benefit Payout: Upon the policyholder’s passing, an IUL policy pays out a death benefit to the beneficiary. This lump-sum payment can be used to cover funeral and memorial expenses, ensuring a dignified farewell without creating a financial burden for the family.

Immediate Access: Unlike the delay associated with crowdfunding campaigns, the death benefit from an IUL policy is typically paid out promptly, allowing the family to make timely arrangements and cover funeral expenses without the stress of waiting for donations.

Incorporating an IUL into your financial plan can provide comprehensive protection not only for your loved ones in the event of your passing but also for yourself during life’s unexpected health challenges, financial strains, and emergencies. The living benefits, disability coverage, and senior care substitute make an IUL a versatile and robust financial tool that can help alleviate the financial burden associated with these common triggers for establishing fundraising accounts, including funeral and memorial expenses. However, it’s crucial to work closely with a financial advisor to design an IUL policy that aligns with your specific needs and goals.