Why Would the Government Consider Abolishing 401(k) Plans?

Several factors could lead policymakers to contemplate the abolition of 401(k) plans:

- Tax Revenue Concerns: With an aging population and increasing strain on government resources, policymakers may seek alternative revenue streams to sustain social programs like Medicare and Social Security. Abolishing or modifying tax incentives for retirement savings could be seen as a way to generate additional tax revenue.

- Inequality and Wealth Distribution: Critics argue that 401(k) plans primarily benefit higher-income individuals who can afford to contribute more, exacerbating wealth inequality. Policymakers concerned with addressing income disparities might propose alternative retirement savings models that are more inclusive and equitable.

- Market Volatility and Risk Exposure: The 401(k) system exposes individuals to market risks, as account values fluctuate with market performance. During economic downturns, retirees may experience significant losses, leading to financial hardship. Policymakers may consider alternative retirement savings structures that provide more stability and security, especially for vulnerable populations.

- Retirement Security Concerns: Some policymakers argue that relying solely on individual retirement savings plans like 401(k)s places too much responsibility on individuals to adequately prepare for retirement. They may advocate for government-managed retirement programs or enhancements to Social Security to ensure a more robust safety net for retirees.

Potential Implications of Abolishing 401(k) Plans:

Should the government move forward with abolishing 401(k) plans, it would have significant implications for both individuals and the broader economy:

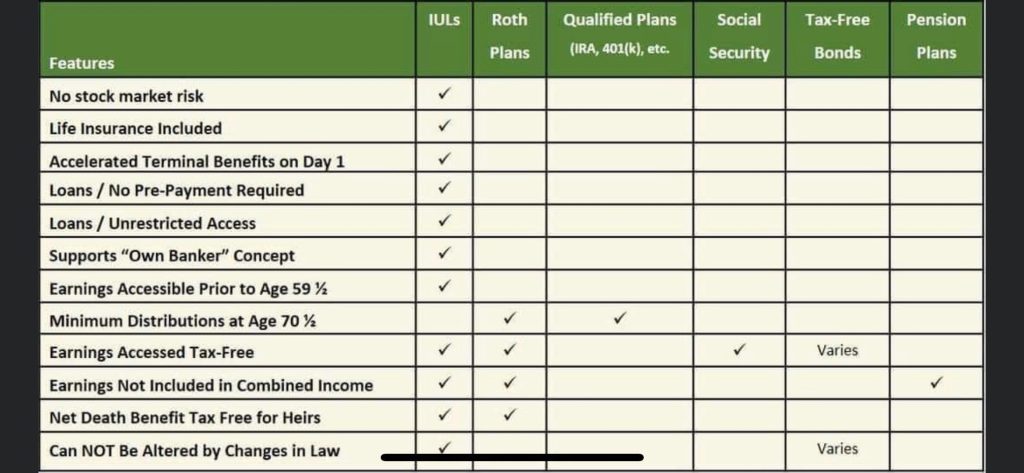

- Impact on Retirement Savings: Individuals who have diligently contributed to their 401(k) plans would need to reassess their retirement strategies. Without the tax advantages and employer matches provided by 401(k) plans, they may need to explore alternative retirement savings options such as Individual Retirement Accounts (IRAs), taxable investment accounts, or employer-sponsored alternatives if available.

- Employer Benefits and Compensation: Employers offering 401(k) plans as part of their benefits package would need to reconsider their retirement benefits offerings. This could affect employee recruitment, retention, and overall compensation packages.

- Economic Effects: The abolition of 401(k) plans could have ripple effects throughout the economy, impacting financial markets, investment firms, and retirement-focused industries. Changes in consumer behavior related to retirement savings could also affect sectors such as housing, healthcare, and leisure.

- Policy Repercussions: Any proposed changes to retirement savings policies would likely face scrutiny and debate in legislative bodies. Political considerations, public opinion, and industry lobbying could influence the final outcome, leading to potential compromises or alternative solutions.

Conclusion:

While the possibility of the government abolishing 401(k) plans remains speculative at this point, it is essential for individuals to stay informed and proactive about their retirement planning. Diversifying retirement savings strategies, staying abreast of legislative developments, and seeking professional financial advice can help individuals navigate potential changes to retirement savings policies and secure their financial futures. Ultimately, whether or not the government decides to abolish 401(k) plans, understanding the broader implications and exploring alternative retirement savings options is cr